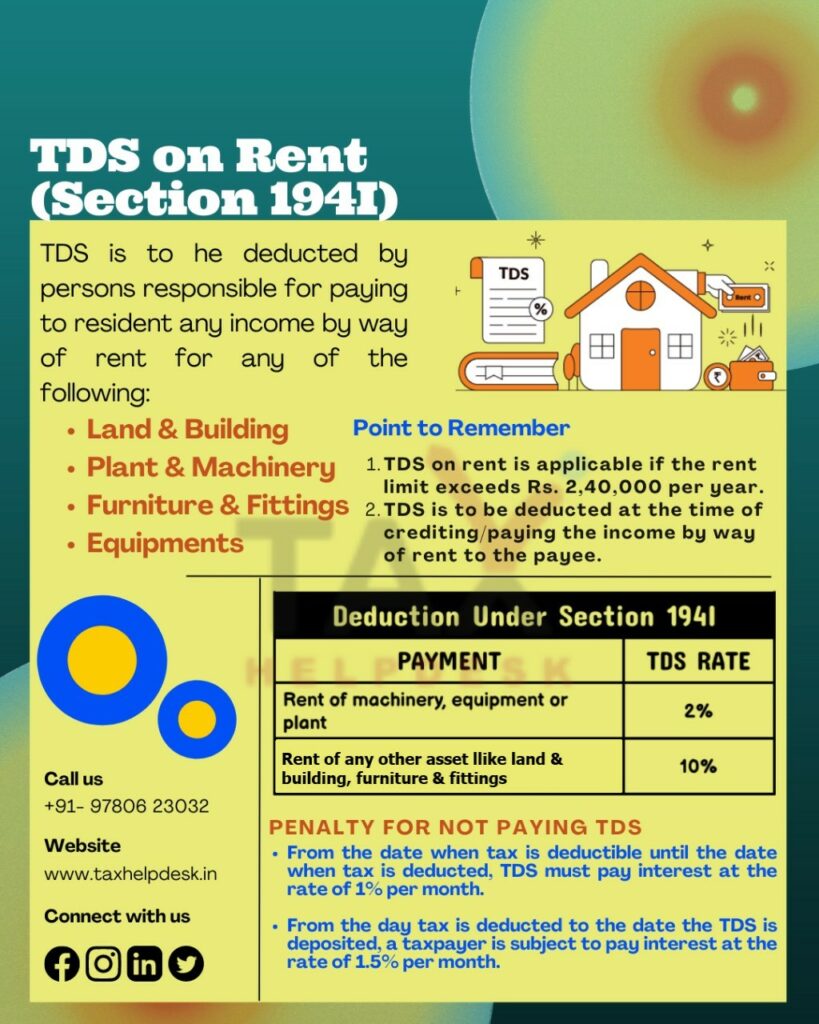

TDS on rent is to be deducted by the persons making payment of rent to resident Indian. The same has been provided under Section 194I of the Income Tax Act.

What is Rent for the purposes of TDS on Rent?

Rent for the purposes of TDS on Rent means any payment, by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of either separately or together any:-

a) land; or

b) Building (including factory building); or

c) Land appurtenant to a building (including factory building); or

d) Machinery; or

e) Plant; or

f) Equipment; or

g) Furniture; or

h) Fittings

Whether or not any or all of the above are owned by the payee.

TDS on rent limit

TDS on rent limit has been set at Rs. 2,40,000 for each financial year. In other words, TDS on rent is to be deducted when the rent payment is made of more than Rs. 2,40,000 aggregately.

Note:

Earlier the TDS on rent limit was set at Rs. 1,80,000 for each financial year. This limit has been increased to Rs. 2,40,000 from FY 2019-2020.

Criteria involved in TDS on Rent

Following are the criteria’s involved in TDS on Rent:

– TDS on rent does not charge any cess.

– There is no surcharge levied on TDS on rent except where a foreign company is involved or the payment is above Rs.1 crore.

– For TDS deduction, PAN card number of the landlord/owner or the person receiving rent, is required to be given to the payee. If it is not shared, TDS on rent is deducted at 20% under Section 206AA.

– If the tenant pays ground rent, municipal taxes, etc., then no TDS is to be charged on those amounts.

– While TDS is charged on non-refundable deposits made to the landlord/owner, serving as security deposit for using the asset, no TDS is deducted from refundable deposits.

– For hotel accommodation, where payment is made on regular basis, TDS is levied.

What all does TDS for Rent Payment under Section 194I cover?

The TDS on rent payment under Section 194I covers the following:

Rent from Factory Building: When a factory building is given on rent, the rent is given to the owner of the factory or the lessor. In some cases, owner/lessor receives it as income from property. In these cases, the rent is considered to be as business income to owner/lessor. This will require him or her to pay an advance tax, returning the income from rent as there will be deduction of tax at source.

Rent from Furniture and Building by two individuals: When the building and furniture is let out by two different individuals, the tax is deducted only from the building rent.

Rent from Cold Storage Facility: Cold storage facilities where ice cream, vegetables, fruits or milk are stored, are considered as a plant. Further, the arrangement between customer & cold storage owners is contractual in nature, as the contract includes provision of cooling facilities, security services and other miscellaneous utilities. Therefore TDS is to be deducted under Section 194C, and not under Section 194I. (Circular No. 1/2008 dated 10th January, 2008)

Rent from Hotel holding Seminars with Meals: When hotels do not charge for using the premises but only for catering or food, then Section 194I will not apply. While for catering, Section 194C is applied.

Service Charges Payable to Business Centres: Service charges that are paid to business centres are also considered as rent. Hence, Section 194I shall apply.

Tax Deduction as per Rent Period: It is not mandatory that tax is deducted always on a monthly basis. It depends on the rent period and amount. Accordingly, TDS is deducted. For example, if the rent is yearly, tax deduction is also done every year.

Hall Rented by an Association: If an association rents a hall, tax is deducted if the rent charged for it is higher than Rs.2,40,000.

Also Read: Section 192: TDS On Salary

Cases where TDS is not deducted on rent

There are certain cases where there is TDS is not deducted on rent, which are follows:

– Amount paid or payable not more than Rs.2,40,000 in the fiscal year: If the amount of rent paid to the landlord/owner or lessor in the financial year is not higher than Rs.2,40,000 then, no tax is deductible.

– Paying a Government Agency: Section 196 states that no tax is required to be deducted at source when any amount is paid to a government agency. According to Section 10 (20A), an amount charged for housing accommodation or development, planning or improvement of towns, villages and cities in the country is exempt of any tax deduction at source. If rent of any kind is payable to a government agency, local or statutory authorities, tax deduction at source is not applicable as per clause (20) or (20A) of Section 10.

– Individual Tenant or Hindu Undivided Family not liable for tax audit: Section 194I states that no tax is to be deducted from amount payable or to be paid by an H.U.F. or an individual, if the individual or H.U.F. is not involved in any profession/business or if the individual or H.U.F was not liable to tax audit in the preceding financial year.

– When Proceeds are shared by a Film Exhibitor and Distributor owning a Cinema Theatre: According to Section 194I, when proceeds are shared between a film exhibitor and distributor who own a cinema theatre, there are no such charges levied. Reason being that the cinema hall is not being let out by the exhibitor to the distributor and that the exhibitor’s share is from composite services.

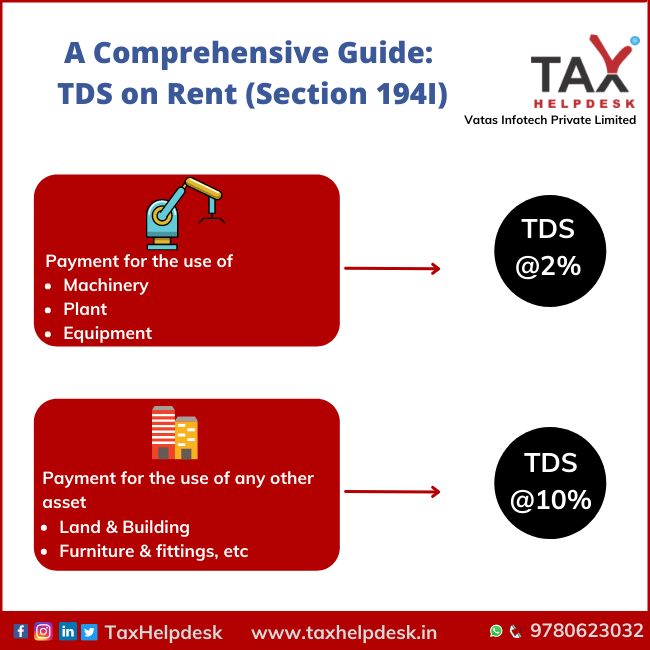

TDS Rates applicable on Rent Payment

| Payment | TDS Rate |

|---|---|

| Rent of machinery, equipment or plant | 2% |

| Rent of land, furniture, or building to other than HUF or individual | 10% |

Due Date To Deposit TDS

| Period | Due Date |

|---|---|

| April – February | Within 7 days from the end of the month in which the tax is deducted. |

| March | On or before 30th April |

Due Dates To File TDS Returns Under Section 194I

| Quarter | Quarter Period | Last date of filing |

|---|---|---|

| Q1 | 1st April – 30th June | 31st July |

| Q2 | 1st July – 30th September | 31st October |

| Q3 | 1st October – 31st December | 31st January |

| Q4 | 1st January – 31st March | 31st May |

Consequences Of Not Deducting TDS Or Deducting But Not Depositing It

Levy of Interest : If the specified person does not deduct TDS or deducts TDS but does not deposit it to the government on time, then interest @1.5% is required to be paid on such amount.

Disallowance of expenses : Further, the person is not eligible to claim the deduction of expenses from Profits and Gains from Business & Profession income, if TDS is not deducted on time. The amount of disallowed expenses shall be 30% of payment

However, if TDS is deposited in subsequent years, then expense will be allowed in the year of payment of TDS.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn, and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: A Comprehensive Guide: TDS on Rent (Section 194...