Deduction of TDS on interests other than those on securities, such as interest on fixed deposits, interest on loans, and advances from sources other than banks, is covered by Section 194A.

Who has to pay TDS on Interest under Section 194A?

The TDS on interest under Section 194A is applicable on resident Indians and HUFs. But, that does not mean that no TDS on interest is applicable for non-resident Indians. The non-residents are also liable to pay TDS but that is under Section 195 of the Income Tax Act.

Who is liable to deduct TDS on Interest?

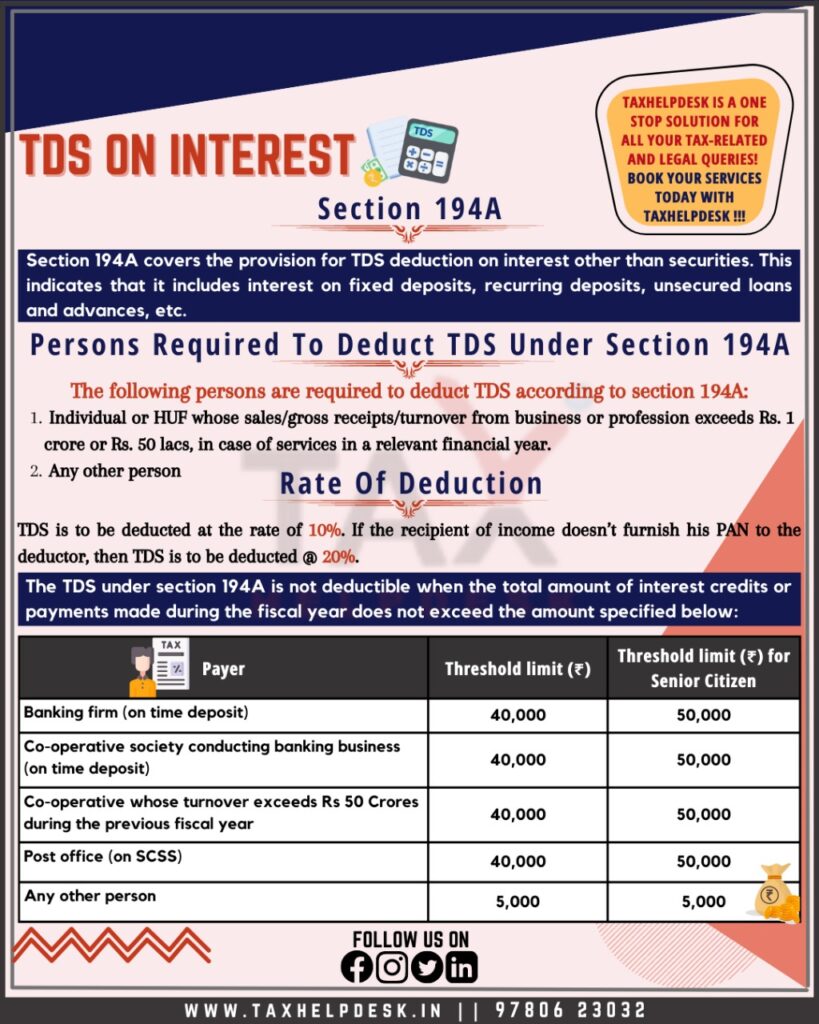

Following persons are liable to deduct TDS on interest:

Firstly, an individual or HUF whose sales/gross receipts/turnover from business or profession exceeds Rs. 1 crore or Rs. 50 lacs, in case of services in a relevant financial year.

Secondly, all other persons are also liable to deduct TDS on interest. These other persons are as follows:

– Partnership firms including LLPs

– Company

– Association of Persons

– Body of Individuals

– Trusts

– Societies, etc

Also Read: TDS Section 194R: All You Need To Learn

Is TDS compulsory on interest income?

The TDS on interest income is compulsory only if the income amount exceeds the following threshold limits:

| Payer | Threshold limit (for non-senior citizens) | Threshold limit (for senior citizens) |

|---|---|---|

| Banking firm (on time deposit) | Rs. 40,000 | Rs. 50,000 |

| Co-operative society conducting banking business (on time deposit) | Rs. 40,000 | Rs. 50,000 |

| Co-operative whose turnover exceeds Rs. 50 crores during the previous fiscal year | Rs. 40,000 | Rs. 50,000 |

| Post Office (on SCSS) | Rs. 40,000 | Rs. 50,000 |

| Any other person | Rs. 5,000 | Rs. 5,000 |

In addition to the above, no TDS on interest income is applicable if the individual furnishes to the payer Form 15G/15H to the payer. In other words, no TDS on interest is to be deducted if the individual declares to the payer that his income is below the exemption limit.

Also Read: Understand TDS Deduction: If Person Is Resident In India

Other cases where TDS on interest is not applicable

The TDS on interest is not applicable if there is crediting or payment of interest by any of the following persons:

– Partnership firm to its partners

– Banking company to which the Banking Regulation Act, 1949, applies,

– Co-operative society engaged in carrying on the business of banking (including a co-operative land mortgage bank).

– Financial corporation whose establishment is by or under a Central, State or Provincial Act

– Life Insurance Corporation of India whose establishment is under the Life Insurance Corporation Act, 1956.

– Unit Trust of India whose establishment is under the Unit Trust of India Act, 1963.

– Any company or co-operative society carrying on the business of insurance.

– Any other institution, association or body or class of institutions, associations or bodies which the Central Government may notify on or before 31- 03-2021.

– A co-operative society (other than a co-operative bank) to a member thereof or to such income credited or paid by a co-operative society to any other co-operative society.

– Deposits notified by the Central Government.

– Central Government under any provision of Income-tax Act, 1961 or Wealth-tax Act, 1957.

– Infrastructure capital company or infrastructure capital fund or infrastructure debt fund or a public sector company or scheduled bank in relation to a zero coupon bond issued on or after the 1st day of June, 2005

– Special purpose vehicle to business trust as given in section 10(23FC) [from 1-10-2015].

Also Read: Section 192: TDS On Salary

Rate of TDS on interest income

If the recipient of the income furnishes his PAN Card, then the rate of TDS applicable is 10%. On the other hand, if the recipient does not furnish his PAN Card, then the rate of TDS applicable is 20%.

Note:

No surcharge and cess is applicable on the above TDS rates.

Also Read: Know About The TDS Rates For FY 2022-23 Easily Explained

When is the TDS deduction to be made?

The persons responsible for deducting TDS on interest income can deduct TDS in earlier of the following cases:

– Either at the time of payment of interest thereof in either cash, cheque, draft or any other mode

– Or when the said interest payment is credited to the account of the individual receiving the tax i.e., the payee

What is the time limit to deposit TDS under Section 194A?

| Period | Due Date |

|---|---|

| April – February | Within 7 days from the end of the month in which the tax is deducted. |

| March | On or before 30th April |

Due date for filing TDS Returns

| Payer | Threshold limit (for non-senior citizens) | Threshold limit (for senior citizens) |

|---|---|---|

| Banking firm (on time deposit) | Rs. 40,000 | Rs. 50,000 |

| Co-operative society conducting banking business (on time deposit) | Rs. 40,000 | Rs. 50,000 |

| Co-operative whose turnover exceeds Rs. 50 crores during the previous fiscal year | Rs. 40,000 | Rs. 50,000 |

| Post Office (on SCSS) | Rs. 40,000 | Rs. 50,000 |

| Any other person | Rs. 5,000 | Rs. 5,000 |

Consequences Of Not Deducting TDS Or Deducting But Not Depositing It

These are the following two consequences:

Levy of Interest : If the specified person does not deduct TDS or deducts TDS but does not deposit it to the government on time, then interest @1.5% is required to be paid on such amount.

Disallowance of expenses : Further, the person is not eligible to claim the deduction of expenses from Profits and Gains from Business & Profession income, if TDS is not deducted on time. The amount of disallowed expenses shall be 30% of payment

However, if TDS is deposited in subsequent years, then the expense will be allowed in the year of payment of TDS.

Follow TaxHelpdesk on Facebook, Instagram, LinkedIn, and Twitter.

Disclaimer: The views here are of the author and TaxHelpdesk does not owe any liability.