New TDS rates changes are made applicable from 1st October 2024. Having said this, these changes were brought through the Union Budget 2024 but are effective from the first day of October.

New TDS Rates Changes

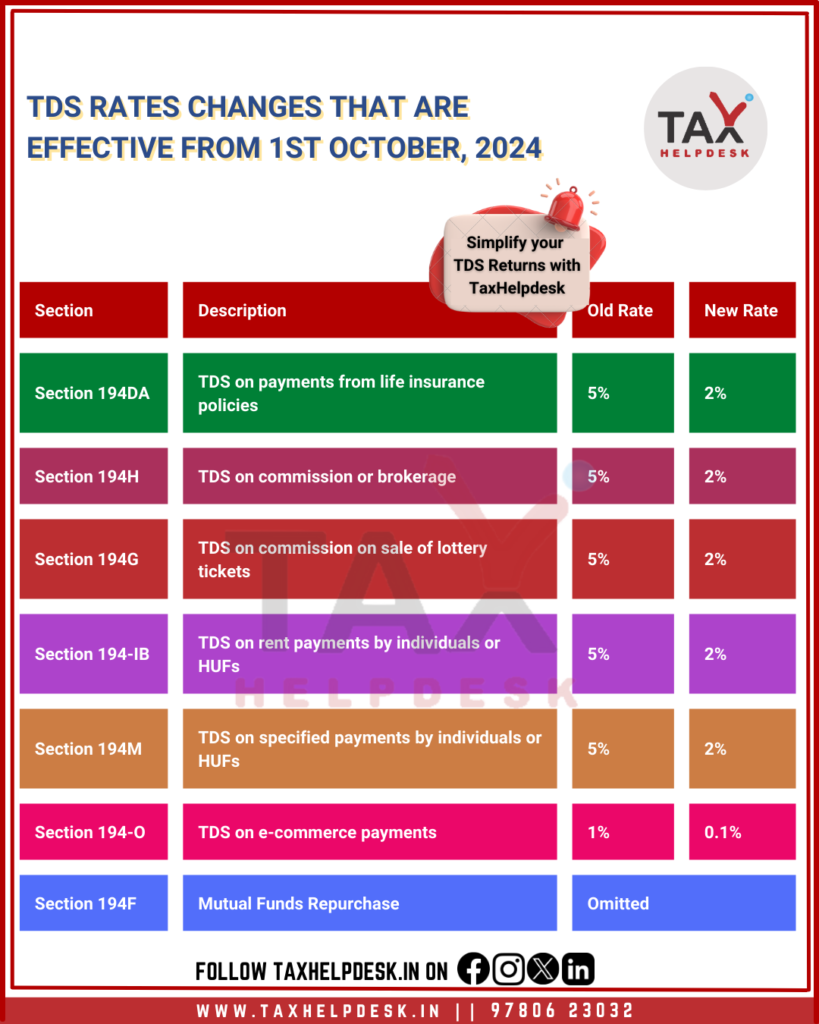

The list of new TDS rates changes that are applicable from 1st October, 2024 are as follows:

TDS on payments from Life insurance policies (Section 194DA): There is a reduction of TDS rate on payments from life insurance policies from 5% to 2%.

TDS on commission on sale of lottery tickets (Section 194G): There is also a reduction in TDS rate on commissions from lottery ticket sales. The new TDS rate is 2%. Earlier this rate was 5%.

Commission or Brokerage TDS (Section 194H): As per the earlier rates, there was a deduction of 5% TDS on commission or brokerage. But w.e.f., from October 1, 2024, this rate is now 2%.

TDS on rent payments by individuals or HUFs (Section 194-IB): Rent payments made by individuals or HUFs will now face a 2% TDS rate. Earlier, this rate was also 5%.

Certain payments by individuals or HUF (Section 194M): Now, there will be a 2% TDS on certain payments made by individuals or HUF. Earlier, this rate was also 5%.

TDS on payments by E-commerce operators (Section 194-O): Payments by e-commerce operators to participants will now attract a TDS rate of 0.1%, down from 1%.

Mutual funds repurchase (Section 194F): In addition to the above the TDS rate changes, there is an omission of TDS on repurchases by mutual funds or Unit Trust of India from the Income Tax Act. This is to say, that w.e.f., 1st October 2024, Section 194F will not be applicable.

Also Read: TDS Rate Chart FY 2024-2025 | AY 2025-2026: All You Need To Know

Additional Changes that are applicable from 1st October, 2024

Apart from the above TDS rates changes, following changes are also applicable from 1st October 2024:

TDS on floating rate bonds: A 10% TDS now applies to central and state government bonds. These bonds include floating rate bonds. Further, the TDS is applicable with revenue exceeding Rs 10,000 annually.

Share buybacks: Share buybacks will now be subject to shareholder-level taxes. This treatment will be similar to dividends. Accordingly, it will increase the tax burden for investors.

Securities Transaction Tax (STT): There is an increase in STT on Futures & Options (F&O) to 0.02% and 0.1%, respectively, with additional taxes on share buybacks.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box. Alternatively, you can DM us on Whatsapp, Facebook, Instagram, LinkedIn and X (Formerly Twitter). Further, for more updates on tax, financial and legal matters, please join our group on WhatsApp!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!