GST Invoices

GST invoices are the important documents. This is so because it not only evidences the supply of goods or services but is also an essential document for the recipient to avail Input Tax Credit (ITC). Further, a registered person cannot avail Input Tax Credit unless he is in possession of a tax invoice or a debit note.

In addition to the above, GST is chargeable at the time of supply. Therefore, the invoice is an important indicator of the time of supply.

In this article, we will discuss various types of invoices under GST

Also Read: Various types of supply under GST

Types of GST Invoices

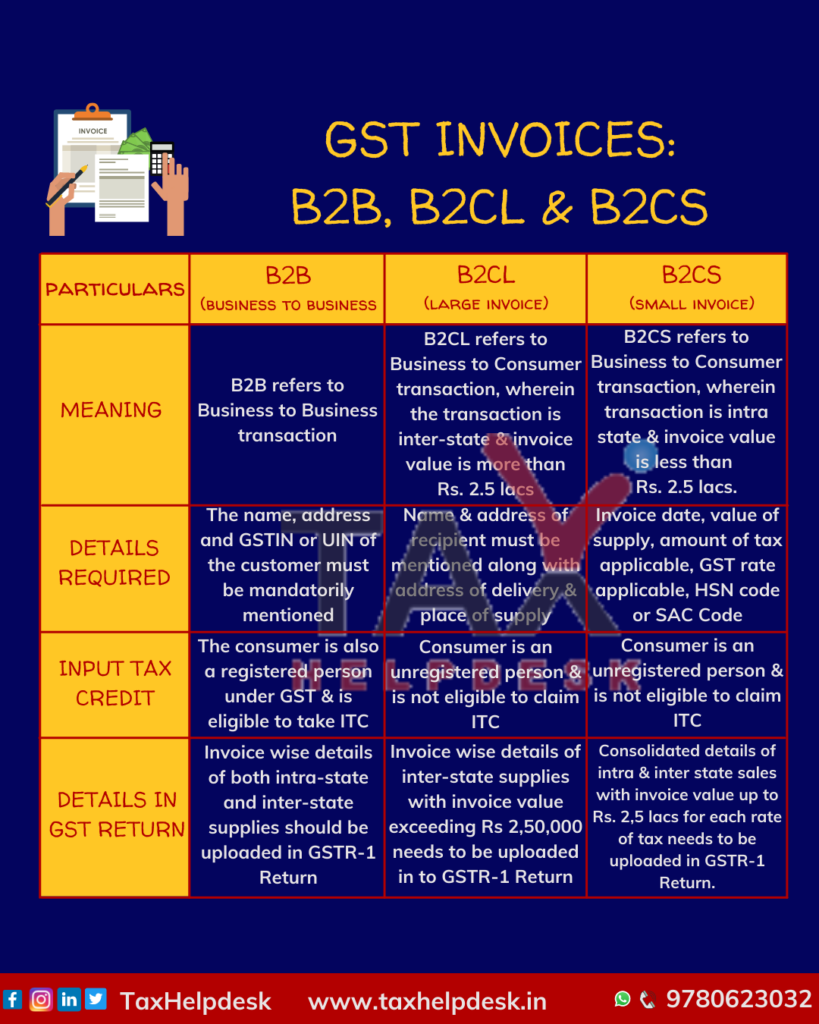

The GST invoices are of three types:

Firstly, B2B GST Invoices (Business to Business Invoice)

Secondly, B2CL GST Invoices [Business to Consumer (Large Invoices)]

Lastly, B2CS GST Invoices [Business to Consumer (Small Invoices)]

B2B GST Invoices (Business to Business Invoice)

B2B Invoice refers to a business-to-business transaction invoice.

Accordingly, the requirements of B2B GST invoices are as follows:

– There must be compulsorily mentioning of the name, address, and GSTIN or UIN of the customer.

– The consumer should also compulsorily have a GST Registration as well as must be eligible to take Input Tax Credit.

– Moreover, the invoice-wise details of both intra-state and inter-state supplies should be uploaded in GSTR-1 Return.

B2CL GST Invoice [Business to Consumer (Large Invoice)]

B2CL Invoice refers to a Business-to-Consumer transaction, wherein the transaction is inter-state and invoice value is large i.e., more than Rs. 2.5 lacs.

Accordingly, the essentials of B2CL GST Invoice are as follows:

– The name and address of the recipient must be mentioned along with the address of delivery as well as place of supply.

– The consumer should not have GST Registration and thereby, should not be eligible to take Input Tax Credit.

– Additionally, there must be uploading of invoice-wise details of inter-state supplies with invoice value exceeding Rs 2,50,000 into GSTR-1 Return.

Also Read: Qualifications for GST Registration

B2CS GST Invoice [Business to Consumer (Small Invoice)]

Lastly, B2CS GST Invoice refers to a Business-to-Consumer transaction, wherein the transaction is intra-state and the invoice value does not exceed more than Rs. 2.5 lacs.

Now, the necessities of a B2CS GST Invoice are as follows:

– The invoice must be serially numbered. Moreover, it should contain the invoice date, the value of supply, amount of tax applicable, GST rate applicable, and HSN code or SAC code of the goods supplied.

– The consumer is an unregistered person and thereby, is not eligible to take Input Tax Credit.

– In addition, the consolidated details of intra-state sales for each tax rate, as well as inter-state sales with invoice value up to Rs. 2,50,000/- for each rate of tax needs to be uploaded in GSTR-1 Return.

Mandatory details in GST Invoice

The mandatory details are as follows:

– Name, GSTIN, and address of the supplier

– Invoice Number

– Date of issuance

– Invoice type

– Shipping & billing address

– Name of the Customer

– GSTIN of the customer, if applicable

– Details of products and services including description, quantity, etc

– SAC or HSN Code

– Rate of CGST, SGST, and IGST

– Total tax amounts and discounts, if any

– Reverse Charge

– Additionally, the signature if the invoice issuer

Also Read: GST e-Way Bill [Ultimate Guide]

When is Invoice to be Issued?

The time for issuing an invoice would depend on the nature of the supply. That is to say, whether there is a supply of goods or services. Further, the supply of goods and services can either be a normal one or a continuous one. Accordingly, the following explains when can you issue an invoice:

| Nature of Transaction | Time of Issuing GST Invoice |

|---|---|

| Supply of Goods | Before or at the time of delivery of goods |

| Supply of Services | Within 30 days from the date of supply of services |

| Continuous Supply of Goods | Before or at the time of issue of statement of accounts or receipt of payment |

| Continuous Supply of Services | Within 30 days from the date of issue of statement of accounts or receipt of payment |

| Reverse Charge Mechanism | On or before the payment date or the date of receipt of payment, whichever is earlier |

| Export of Goods or Services | Before or at the time of removal of goods for export or the provision of services |

| Bill of Entry | Before or at the time of filing the Bill of Entry |

| Time of Supply Not Determinable at the Time of Issue of Invoice | Before or at the time of receipt of payment |

For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook and Instagram!

Pingback: Reverse Charge Mechanism Under GST | TaxHelpdesk

Pingback: Various Types of Supplies Under GST | TaxHelpdesk

Pingback: Know about credit note under GST | TaxHelpdesk

Pingback: Benefits of Filing GST Returns on Time | TaxHelpdesk

Pingback: Key Changes in GST That are Effective from January, 2021 | TaxHelpdesk