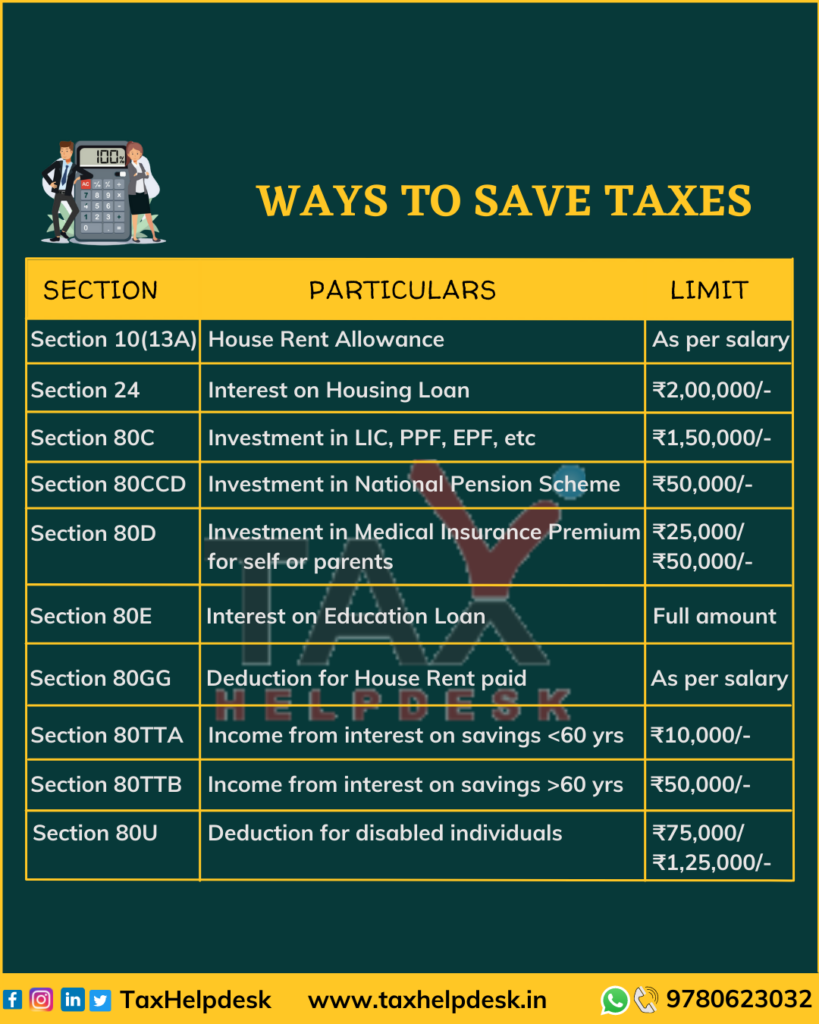

We have a perception that the best ways to save taxes in India are just under Section 80C. However, that is not the case. There are various other ways to save taxes and, in this blog, we have compiled all these ways:

Best ways to save your taxes in India

1. House Rent Allowance

Firstly, the House Rent Allowance or HRA is one of the best ways to save your taxes. It is so because there is an exemption from tax in the case of HRA. This, however, is available only

– to employees opting for the Old Tax Regime,

– residing in rented accommodation and

– paying rent to their respective owner.

The employee can avail of exemption of HRA by submitting the proofs of the rent paid to the employer or at the file of filing Income Tax Returns.

Having stated that, the amount of HRA exempted from the income tax is the least of the following:

| S.No. | Particulars |

|---|---|

| a) | HRA received from an employer |

| b) | Actual rent paid less 10% of basic monthly salary |

| c) | 50% of basic salary, if taxpayer is living in a metropolitan city |

| d) | 40% of basic salary, if taxpayer is living in a metropolitan city |

Also Read: Can I Claim HRA Even if I Own A House?

2. Housing loan interest

Secondly, under the Income Tax Act, an individual opting for the Old Tax Regime can claim interest paid on a housing loan as a deduction from gross total income. Through the budget of July 2019, there was an enhancement of the amount of interest on housing loans from Rs. 2 lacs to Rs. 3.5 lacs, for those buying houses under affordable housing schemes. In addition to this, through the Union Budget, 2021, there was an extension of this scheme up to 31st March 2022.

Additionally, under Section 80C of the Act, you can get a deduction of the principal (of the loan) repaid up to Rs 1.5 lakh a year and the interest paid is deductible up to Rs 2 lakh per annum under section 24 of the Act.

Also, under Section 80EEA, first time home buyers can claim a deduction of up to Rs. 1,50,000, subject to certain conditions.

Also Read: Tax Benefits On Home Loan: Know More At TaxHelpdesk

Some other Ways To Save Taxes In India

3. Life Insurance

Thirdly, life insurance is one of the necessities to secure your and your loved ones’ life. The Income Tax Act provides tax exemption for investment in life insurance under Section 10(10D) and tax deduction under Section 80C.

Section 10(10D) of the Income Tax Act grants exemption on the income tax under two categories, which is as follows:

| Particulars | Life Insurance Premium | Premium Criteria |

|---|---|---|

| Section 10(10D) | The insurance policy issued on or after 1st April 2003 but on or before 31st March 2012 | The premium payable, exceeds 20% of the actual capital sum assured, for any of the years (during the term of the policy). |

| Section 10(10D) | The insurance policy issued on or after 1st April 2012 | The premium payable, exceeds 10% of the actual capital sum assured, for any of the years (during the term of the policy). |

On the other hand under Section 80C, premiums paid by you for a life insurance policy are eligible for a tax deduction of up to Rs. 1.5 lacs.

The exemption under Section 10(10D) is available under the Old Tax Regime and New Tax Regime. But deduction under Section 80C is available only under the Old Tax Regime.

Also Read: Documents To Be Submitted To Employer To Claim Tax Benefits

4. Contribution Towards National Pension Scheme

Fourthly, any individual (opting for old or new tax regime) – resident Or non-resident aged between 18 to 60 years can invest In the National Pension Scheme. As per the provisions of the Income Tax Act, an individual can save taxes by claiming deductions under the following Sections- Section 80CCD(1), Section 80CCD(2) and Section 80CCD(1b)

Read more about National Pension Scheme here!

More ways to save your taxes in India

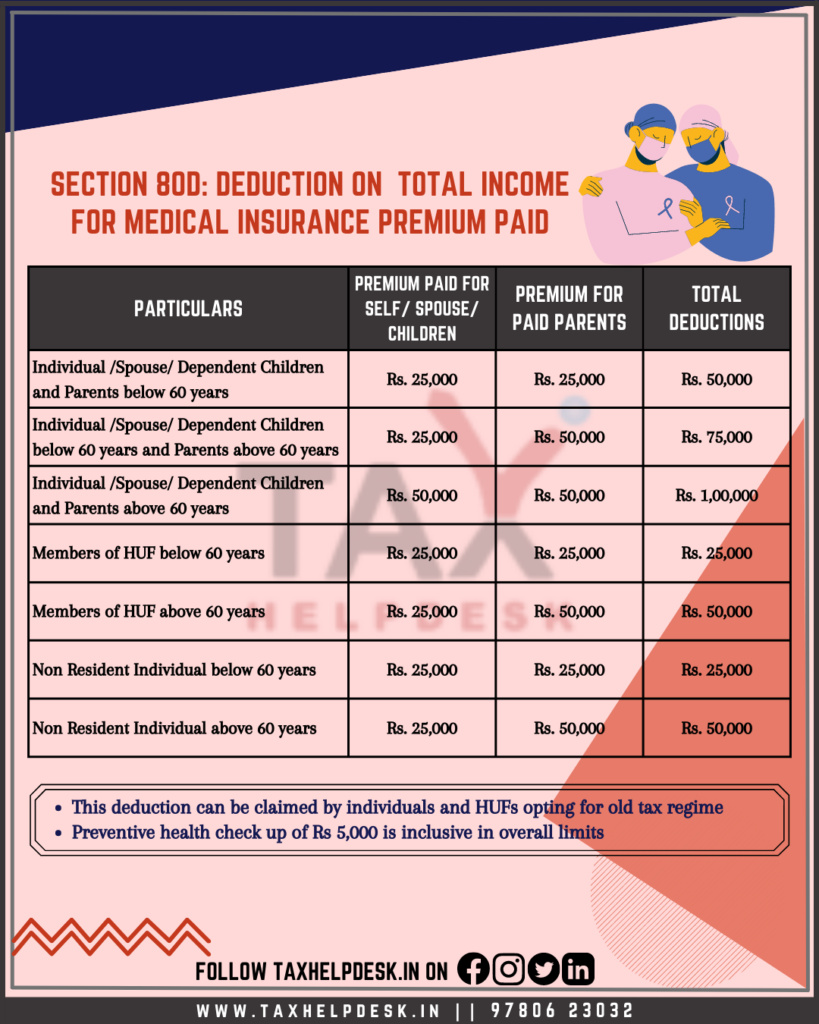

5. Medical Insurance

Fifthly, as per section 80D of the Income Tax Act, every individual who wishes to opt for the Old Tax Regime can claim a deduction for medical insurance. Having said this, the assessee has to make the payment through Cheque. In addition to this, the following table shows the break up of deduction on medical insurance for a family member or parents as follows:

Also Read: Know About Health Insurance Tax Benefits Under Section 80D

6. Education Loan Interest

Interest paid on education loan, which is a part of your EMI is exempted from tax under Section 80E of the Act. This tax deduction, however, is available for a maximum period of 8 years or till the interest is repaid, whichever is earlier. Having said that, this tax benefit can be availed by either the parent or the child i.e., student, depending on who chooses to pay the loan. The whole amount of education loan is exempted from tax.

This deduction is available only under the Old Tax Regime.

Also Read: A Quick Look At Deductions Under Section 80C To Section 80U

7. Deductions for donations made

The donations made to trusts and organizations are eligible for taxes deduction, subject to certain terms and conditions. Moreover, The donations under Section 80G can be broadly classified under four categories, which is as follows:

– 100% deduction (without any qualifying limit)

The first category of donations enjoy 100% tax deduction and are not subject to any qualification limit being met. Donations to the National Defense Fund, Prime Minister’s National Relief Fund, The National Foundation for Communal Harmony, National/State Blood Transfusion Council, etc. qualify for such deductions.

– 50% deduction (without any qualifying limit)

Second category of donations are the ones made towards trusts like Prime Minister’s Drought Relief Fund, National Children’s Fund, Indira Gandhi Memorial Fund, etc. qualify for 50% tax deduction on donated amount.

– 100% deductions (subject to 10% of adjusted gross total income)

The donations made to local authorities or government to promote family planning and donations to Indian Olympic Association qualify for deductions under the third category. In such cases, only 10% of the donor’s Adjusted Gross Total Income is eligible for deductions. Donations which exceed this amount are rounded off to 10%.

– 50% deductions (subject to 10% of adjusted gross total income)

Contributions made to any local authority or the government which would then use it for any charitable purpose qualify for deductions under this category. In such cases, only 10% of the donor’s Adjusted Gross Total Income are eligible for deductions. Furthermore, donations which exceed this amount are capped at 10%.

Also Read: Important Pointers About Restrictions On Cash Transactions

Some more important ways to save taxes in India

8. Income through interest on savings account (< 60 years)

| Particulars | Income Exempted (Below 60 years) | Income Exempted (Above 60 years) |

| Income through interest on savings account | Rs.10,000 | Rs. 50,000 |

Interest on deposits in saving accounts provides deduction to individuals as well as HUFs opting for the old tax regime. If you are an individual below the age of 60 years, then as per Section 80TTA of the Income Tax Act, 1961 the amount of interest on saving accounts of up to Rs. 10,000 can be claimed as a deduction.

Also Read: Major Exemptions & Deductions Availed By Taxpayers In India

9. Income through interest on savings account (> 60 years)

If you are an individual above the age of 60 years, then as per Section 80TTB of the Act, the amount of interest income of upto Rs. 50,000/- can be claimed as a deduction.

10. Deduction for disabled individuals

Under the Section 80U of the Income Tax Act, some extra deductions have been provided to individuals who are suffering from any specified disability. Furthermore, the deduction is provided on gross total income of the individual on the basis of severity of the disabled person.

The quantum of deduction under Section 80U are as follows:

| Disability | Level of disability | Amount |

|---|---|---|

| Normal disability | 40% or above | Rs. 75,000 |

| Severe disability | 80% or above | Rs. 1,25,000 |

Also Read: Income Tax Slab Rates For Individuals Under The Old And New Tax Regime

Have any thoughts or suggestions on how to save your taxes in 2024, then please leave a comment below. You can also contact us for income tax filing online through Whatsapp, Facebook, Instagram, LinkedIn, or Twitter. Join our WhatsApp and Telegram channels for more information on tax, financial, and legal matters!

Disclaimer: The author’s opinions are his or her own, and TaxHelpdesk is not responsible for anything!

Pingback: Know about public provident fund | TaxHelpdesk

Pingback: Decoding Section 87A: Rebate Provision under Income Tax Act | TaxHelpdesk

Pingback: Know Types & Taxability of Mutual Funds SIP | TaxHelpdesk

Pingback: Comparison of Exemptions & Deductions under Old & New Tax Regime | TaxHelpdesk

Pingback: TDS on Cash Withdrawal From Bank – Section 194N | TaxHelpdesk

Pingback: Know tax benefits of purchasing property through Home Loan | TaxHelpdesk

Pingback: Form 16: Relevance, overview & parts of form 16 | TaxHelpdesk

Pingback: Types of Golden Rules of Accounting | TaxHelpdesk

Pingback: Know all About Presumptive Taxation Scheme | TaxHelpdesk