With a view to promote “Housing for All”, a new section namely Section 80EEA was inserted in the Income Tax Act. This Section helps first time home buyers to claim an additional tax of Rs. 1,50,000 during each financial year against the home loan interest payments. Further, the rebate amount under this section is over and above the deduction limit mentioned under Section 24(b) of the Act.

Eligibility Criteria to claim deductions of Section 80EEA

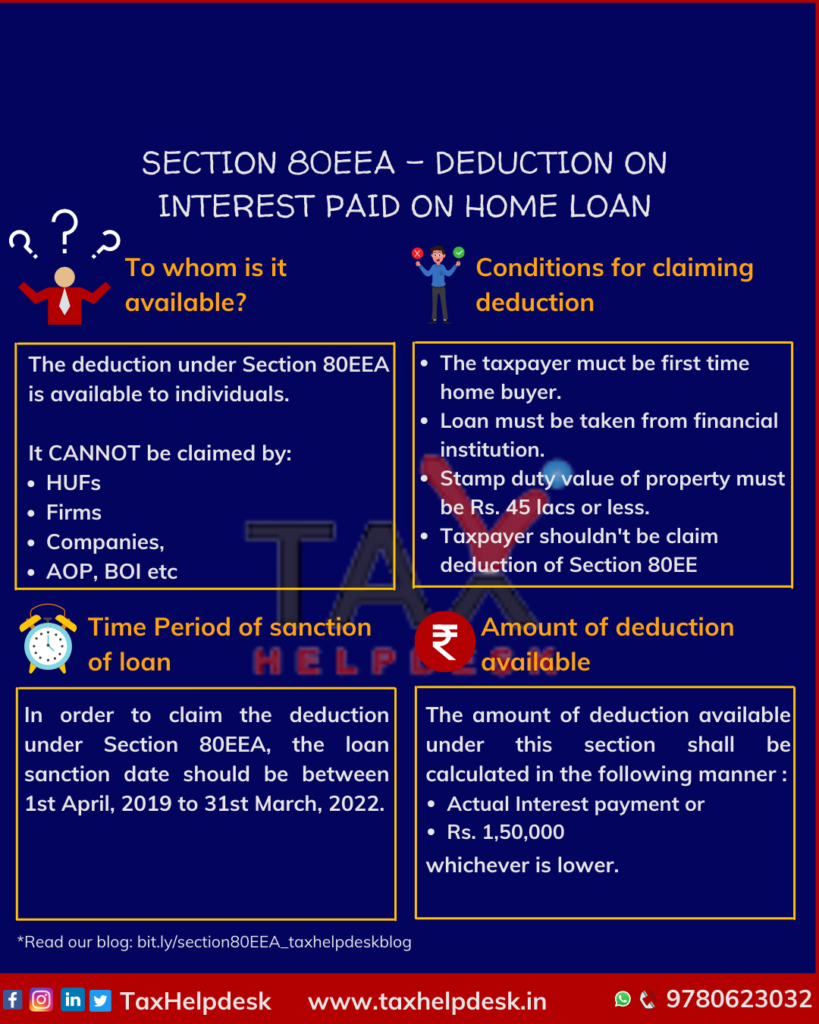

The deduction under Section 80EEA can be claimed only by Individuals. In other words, this deduction cannot be claimed by HUFs, firms, companies, AOPs, BOIs, or any other type of legal persons.

Eligibility Criteria To Claim Deductions Of Section 80EEA

The deduction under Section 80EEA can be claimed only by Individuals. In other words, this deduction cannot be claimed by HUFs, firms, companies, AOPs, BOIs, or any other type of legal persons.

Also Read: 10 Ways To Save Your Taxes!

Time period of sanction of loan for claiming deductions of Section 80EEA

In order to claim the deduction under Section 80EEA, the loan sanction date should be between 1st April, 2019 to 31st March, 2022.

Additional conditions to claim deductions of Section 80EEA

- The taxpayer should be a first-time home buyer. The taxpayer should not own any residential house property as on the date of sanction of the loan.

- Housing loan must be taken from a financial institution or a housing finance company for buying a residential house property.

- Stamp duty value of the house property should be Rs 45 lakhs or less.

- The individual taxpayer should not be eligible to claim deduction under the existing Section 80EE.

Conditions To Be Met Wrt Carpet Area

- Carpet area of the house property should not exceed 60 square meter ( 645 sq ft) in metropolitan cities of Bengaluru, Chennai, Delhi National Capital Region (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (whole of Mumbai Metropolitan Region)

- Carpet area should not exceed 90 square meter (968 sq ft) in any other cities or towns.

- The real estate project must have been approved on or after 1 September 2019.

Amount of deduction available under Section 80EEA

The amount of deduction available under this section shall be calculated in the following manner :

– Actual Interest payment or

– Amount of Rs. 1,50,000/-,

(whichever is lower)

Also Read: Section 80D: Deductions On Medical Expenditure & Health Insurance

Illustration

Amitabh is a first time home buyer and the details of loan taken and interest on home loan by him and deductions available to him are as follows:

| Stamp Duty Value of House Property | Total Interest | Loan taken during | Deduction u/s 24 | Deduction u/s 80EEA | Reasons |

|---|---|---|---|---|---|

| 10,00,000 | 4,50,000 | F.Y. 2016-17 | 2,00,000 | NIL | The loan was taken during the FY 2016-17 |

| 20,00,000 | 4,00,000 | F.Y. 2018-19 | 2,00,000 | Nil | The loan was taken during the FY 2018-19 |

| 30,00,000 | 3,00,000 | F.Y. 2019-20 | 2,00,000 | 1,00,000 | The deduction available under Section 80EEA is calculated over and above the amount of rebate under Section 24(b) and the maximum amount of deduction is actual amount of interest or Rs. 1.5 lacs, whichever is lower. Therefore, only Rs. 1 lac will be available as deduction under Section 80EEA. |

| 40,00,000 | 5,00,000 | F.Y. 2020-21 | 2,00,000 | 1,50,000 | The deduction available under Section 80EEA is calculated over and above the amount of rebate under Section 24(b) and the maximum amount of deduction is actual amount of interest or Rs. 1.5 lacs, whichever is lower. Therefore, in this case Rs. 1.5 lacs will be available as deduction under Section 80EEA. |

| 50,00,000 | 3,00,000 | F.Y. 2021-22 | 2,00,000 | Nil | The stamp duty value of house property is more than Rs. 45 lacs. |

Under this section, rebate of interest payment on home loan maximum upto Rs. 2,00,000 under house property income is available subject to certain conditions.

Deduction on the interest of a home loan under this section is available. The maximum deduction available as per this section is Rs. 50,000/- subject to certain conditions:

- Value of house should be up to Rs. 50 lakh

- Loan amount should not exceed Rs. 35 lakh

- Loan must be sanctioned between 01-April-2016 to 31-March-2017

Yes, if the joint owners meet all the conditions specified in the Income Tax Act, they can claim deduction of Rs1.5 lakh each.

You can claim the deduction under section 80EEA until you have repaid the housing loan.

As a first time home buyer, you can claim deductions under the following sections:

| Section | Amount |

|---|---|

| Section 80C | Rs. 1,50,000 |

| Section 24(b) | Rs. 2,00,000* |

| Section 80EEA | Rs. 1,50,000* |

| Total | Rs. 5,00,000 |

*The amount mentioned above are subject to certain conditions.

If you still have doubts regarding Section 80EE, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Deduction on Electrical Vehicle for Interest Paid on Loan | TaxHelpdesk

Pingback: Section 80G: Deductions on Donations | TaxHelpdesk

Pingback: which Tax Regime Suits you: Old v. New? | TaxHelpdesk

Pingback: Clubbing of Income of Husband And Wife | TaxHelpdesk

Pingback: 10 Ways to Save Your Taxes! | TaxHelpdesk

Pingback: Know about Clubbing of Income of Husband & Wife | TaxHelpdesk

Pingback: Know tax benefits of purchasing property through Home Loan | TaxHelpdesk

Pingback: Know About Systematic Investment Plan (SIP) | TaxHelpdesk