HRA or House Rent Allowance is one of the best ways to save taxes in India. It can be availed by the salaried individuals and is granted by the employer towards payment of rent for residence of the employee.

Also Read: 10 Best Ways to Save Taxes in India

Legal Provisions related to Claiming of HRA

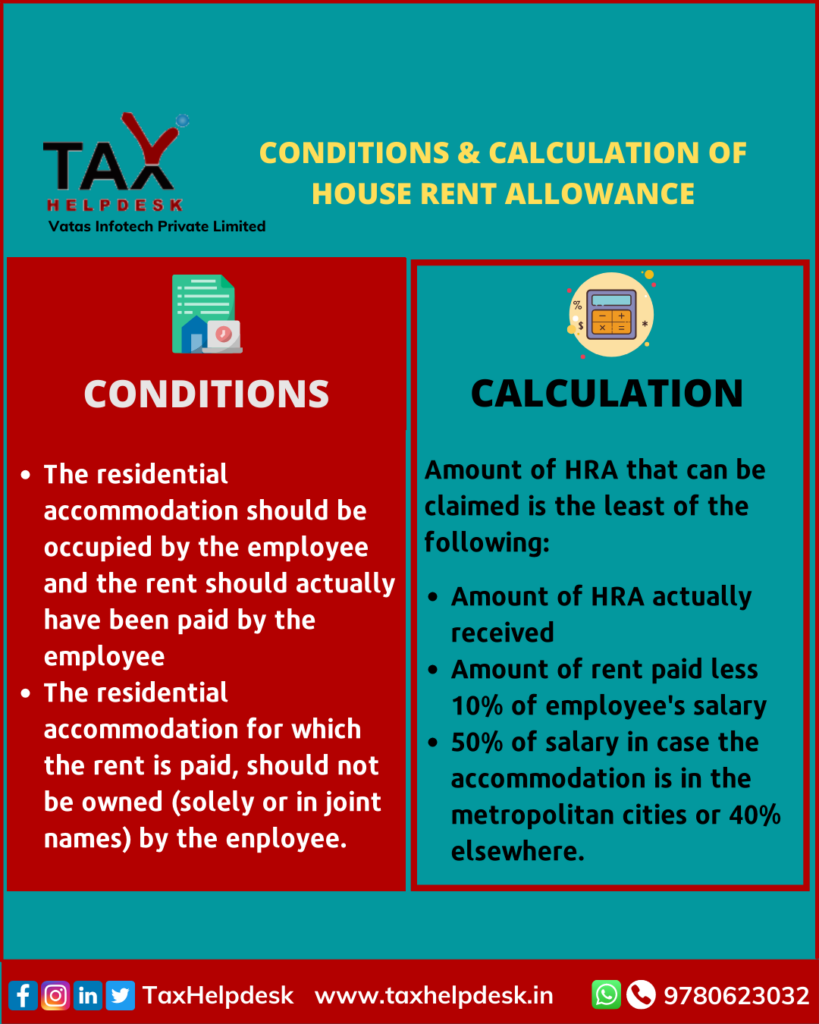

Section 10(13A) of the Income Tax Act provides that a salaried person can claim tax benefits with respect to HRA received from his employer, on fulfilment of certain conditions.

This Section does not contain any condition as to the place for which the employee can claim the HRA exemption, as long as the residential accommodation is occupied by the employee and the other conditions are satisfied.

The law further provides that the benefit of HRA can only be claimed, if the rent has actually been paid by the employee and the residential accommodation, for which the rent is paid, is not owned by the employee.

Now, comes the main question whether you can claim HRA even if you own a property? Well, the answer to this question is dependent on various facts and circumstances. In this blog, we will explain in detail all such cases, wherein the person can or cannot claim HRA, if he owns a property.

Case 1: You live in your own house!

In case you reside in the house which you own, then you cannot claim HRA. However, if you happen to have taken a home loan for the house you’re residing in, then you can claim tax benefits on the principal as well as interest amount.

Same is the scenario if you live in the house jointly owned by you and your siblings or parents.

Also Read: Can I claim HRA even if I’m staying at my parents’ house?

Case 2: You own a house in another city

If you stay in one city and the house owned by you is in another city, then you can claim the benefits of HRA. For example, Mr. Rahul is working and staying on rent in Delhi and he owns a house in Mumbai. In such a case, he can claim HRA for the rent paid for his Delhi house.

Case 3: You own a house but you are staying at your relatives house

In case you own a house but you are staying at your relatives house without paying any rent, then you cannot claim HRA. This is so because in order to claim HRA, you need to incur expenditure of rent.

Mr. Kush is employed in a MNC and stays at his relatives house without paying any rent. In such a case, he cannot claim HRA since there is no rent involved.

Case 4: Your house is not fit to be occupied

If you own a house in a city and still living on rent in another house, in same city, then also claim HRA. This, however, is subject to the condition that house is not fit to be occupied.

For example, Mr. Lakshman owns a house in Delhi but it is under construction. Therefore, is living on rent in another house in Delhi. Since his house cannot be occupied because of under construction, he will be able to claim HRA on the rented house.

Case 5: You own a house but you cannot reside in it

If you own a house in a city and you are residing in another house on rent in the same city, then also you can claim HRA if you have genuine reasons.

Take for instance, Mr. Sughreev owns a house in Sector 1, Noida and goes for work in Sector 105, Noida. He has to travel a lot to reach his work station. Therefore, he decided to take an accommodation on rent in Sector 105, Noida. Since the house owned by Mr. Sughreev is far from his office (genuine reason), he can claim HRA on his rented accommodation.

Case 6: You have rented your own house and currently living in a rented house

In case you have rented your own house and you’re currently living in a rented house, then also you can claim HRA benefits. This is because the residential accommodation for which rent is paid is not owned by the person himself. Therefore, HRA can be claimed.

Illustration: Mr. Bharat owns a house in Mumbai and has rented out the same to Krishna. Further, Bharat stays on rent in Mumbai itself. In this case, he can claim the HRA benefits.

Now that you know all the cases wherein you can claim HRA, even if you own a property, make sure to avail the benefit of the same.

If you want to know more about HRA or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!