The central bank of India i.e., Reserve bank of India (RBI) formulates and monitors various policies which to regulate the flow of money in the economy. These policies also help in controlling the situations of inflation in the country. In this context, repo rate and reverse repo rate are instruments of RBI’s monetary policy that can help control the money supply in the economy.

What is Repo Rate?

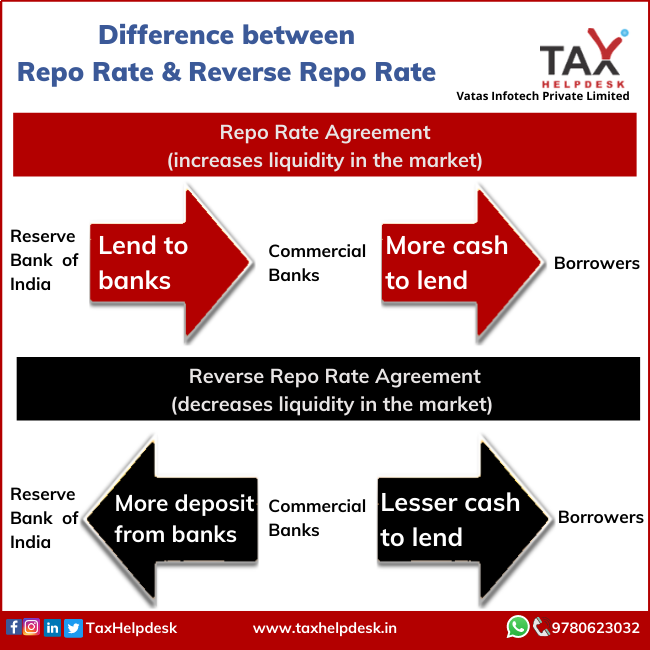

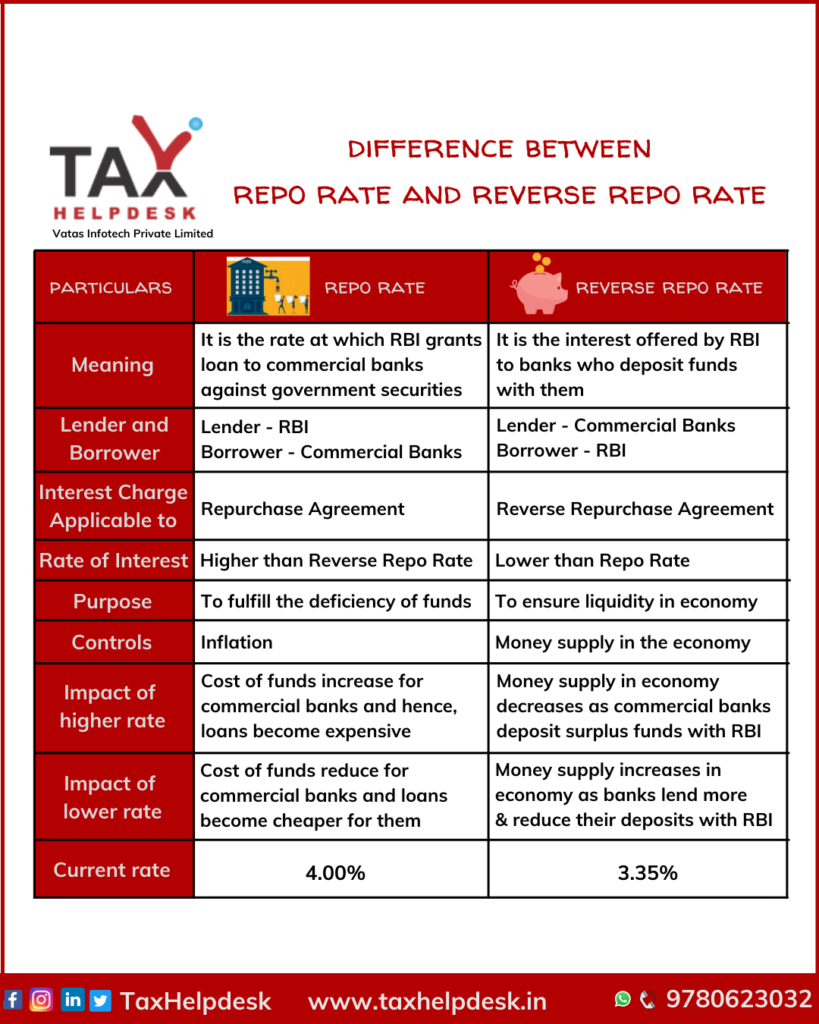

The term “Repo” refers to “Repurchase” and “Rate” refers to the amount of loan. Therefore, Repo Rate is the rate at which the RBI grants loans to commercial banks against government securities and bonds. This loan is for a short period of time.

In the case of Repo Rate, a repurchasing agreement is signed by both parties, stating that the securities will be repurchased at a predetermined price at a given date.

Role of Repo Rate

It helps the Central Bank to control the money supply, liquidity, and inflation in the economy. The current Repo Rate, as of October, 2021 is 4.00%

Also Read: Difference Between Sensex And Nifty

Repo Rate Illustration

The repo rate fixed by the RBI is 4% p.a. and the amount borrowed by a bank (SBI) from RBI is Rs.10,000 for 1 month. The interest rate to be paid by SBI will be Rs. 400.

What is Reverse Repo Rate?

The term “Reverse Repo Rate” is the opposite of the term “Repo Rate”. The Reverse Repo Rate is the rate at which the RBI borrows funds from the commercial banks in the country. In other words, it is the rate at which commercial banks in India deposit their excess money with RBI and earn interest on the same. This also is usually for a short-term.

For Reverse Repo Rate, a reverse repurchasing agreement is signed by both the parties.

Role of Reverse Repo Rate

This is another financial instrument used by the RBI to control the supply of money in the economy. In case, the RBI is falling short on money, it can always ask commercial banks to pitch in with funds and offer them great reverse repo rates in return. This also gives banks and other financial institutions the opportunity to earn profit on their excess funds. The current Reverse Repo Rate is 3.35%.

Illustration of Reverse Repo Rate

The reverse repo rate is 3.35% p.a. A commercial bank (HDFC) has deposited Rs.10,000 in the RBI for a month. This means, the commercial bank will earn interest of Rs. 335.

Increase in Repo Rate: Increase in repo rate makes borrowing from the RBI more expensive for commercial banks and this can lead to increase in rates applicable to loans. As the interest rates on various loans increases, fewer loans are applied for disbursed, which restricts the money supply in the economy and may adversely affect the country’s economic growth. Therefore, increase in repo rate can lead to inflation in the country.

Also Read: How To Treat Income From Transfer Of Shares?

Increase in Reverse Repo Rate: If there is excessive liquidity in the banking system, RBI may decide to increase the reverse repo rate. When there is a hike in reverse repo rate, banks can earn higher interest on their excess funds deposited with the Reserve Bank of India. This is a safer investment option for banks so overall flow of money into the markets will be decreased as more of the bank’s surplus funds are deposited with RBI instead of being lent out.

Impact of Repo Rate and Reverse Repo Rate cuts by RBI

Repo Rate Cut Impact: A cut in repo rate can allow banks to borrow from the Reserve Bank of India at a cheaper rate and infuse higher liquidity in the banking system. This can lead banks to reduce their lending rates for customer leading to cheaper loans in the long term. As bank loans get cheaper, consumers can borrow and spend more which boosts consumption and can eventually lead to economic growth. However, this is dependent on the decisions of the bank whether to pass on the RBI repo rate cut benefits to their customers through cheaper loan offers or not. Therefore, decrease in repo rate can reduce the inflation in the economy.

Reverse Repo Rate Cut Impact: Whenever RBI decides to reduce the reverse repo rate, banks earn less on their excess money deposited with the Reserve Bank of India. This leads the banks to invest more money in more lucrative avenues such as money markets which increases the overall liquidity available in the economy. While this can also lead to lower interest rate on loans for the bank’s customers, the decision will depend on multiple factors including the bank’s internal liquidity situation and the availability of other potentially less risky and equally lucrative investment opportunities.

If you have any suggestions/feedback, then please drop us a message in the chat box. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and Linkedin!

The views of the author are personal and TaxHelpdesk does not owe any liability!