As per the Income Tax laws, any individual whose primary source of income is salary has to file Income Tax Return-1 or ITR-1 form, commonly known as SAHAJ form. In order to file income tax return, the salaried individual must fulfil the following conditions:

– He is a resident of India

– His income must not exceed Rs. 50 lacs

– He should not own more than one house property

– He may have income from other sources such as bank’s saving account interest, fixed deposit interest, etc.

Note:

– ITR-1 cannot be filed by a resident salaried individual who is either a

director in the company or

having investments in unlisted equity shares of a company even if she has

income below Rs 50 lakh.

– ITR-1 can also be filed by individuals having their source of income from pension,

house property or income from other sources.

– Senior citizens of age above 75 years and having only pension and interest

income are exempted from filing Income Tax Returns.

How to file Income Tax Return for salaried individuals?

The Income Tax Return-1 or ITR-1 can be filed by salaried individual in two ways – Offline and Online. In this blog, we will discuss the process of filing Income Tax Return online.

Step 1: Go to Income Tax department’s website

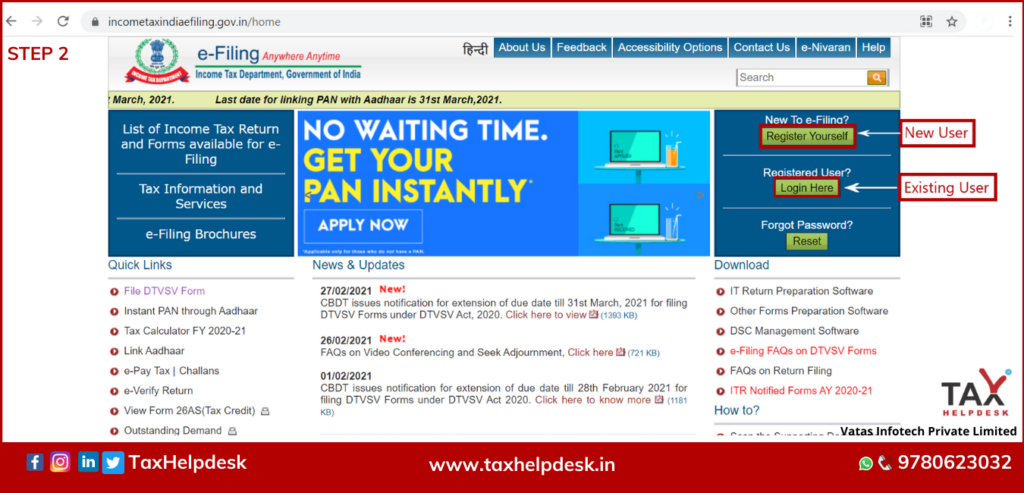

Step 2: Registered user must click on “Login Here” and in case of new user, click on “Register Yourself” and then, login.

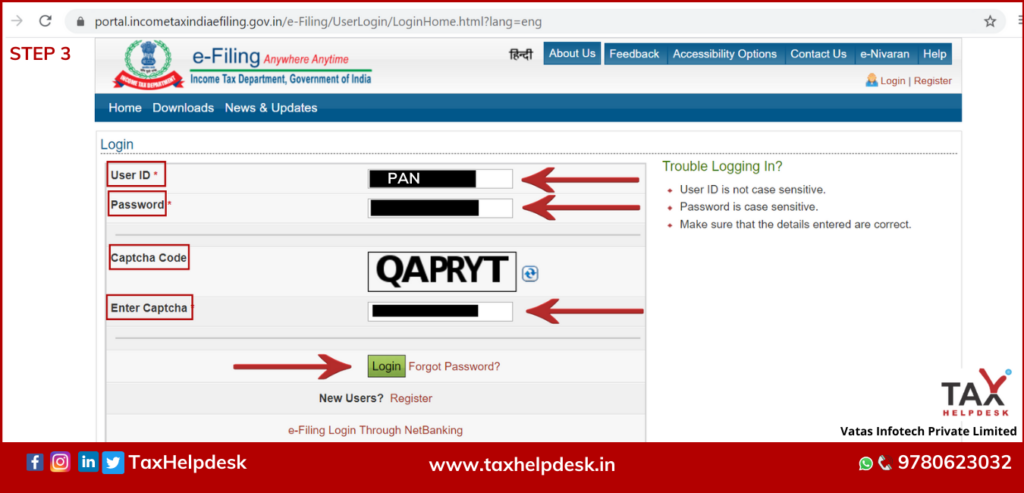

Step 3: Login in to your account by inserting your User ID (PAN), Password and Captcha Code. Now, click on “Login”.

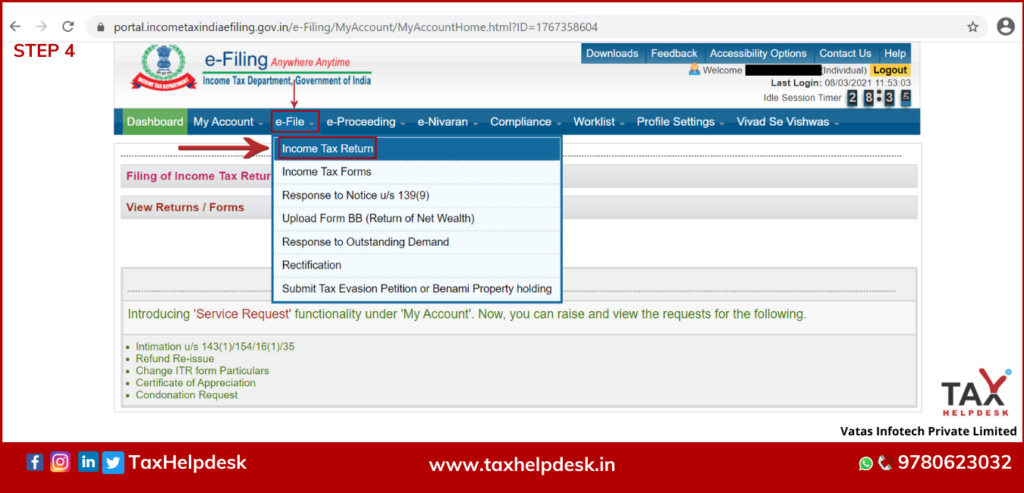

Step 4: Click on the ‘e-File’ menu and click ‘Income Tax Return’ link.

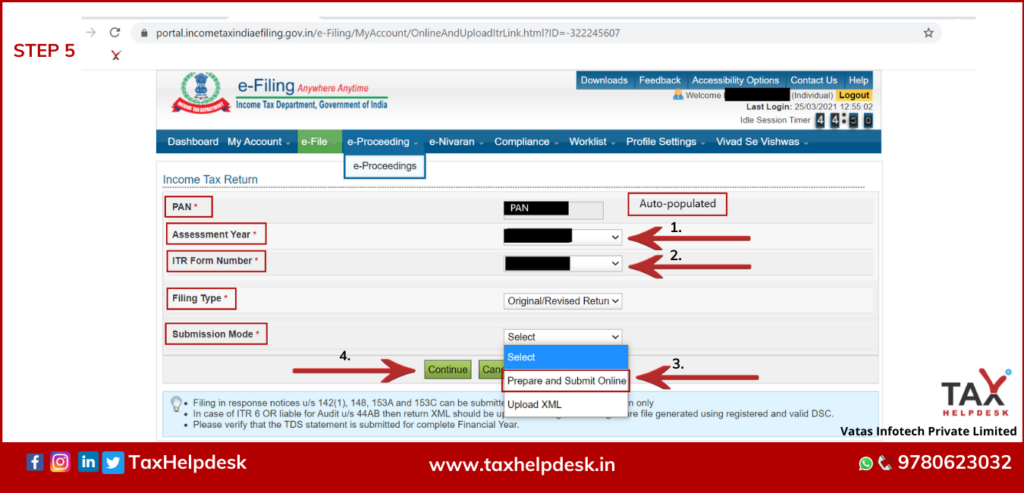

Step 5: On Income Tax Return Page:

– PAN will be auto-populated

– Select ‘Assessment Year’

– Select ‘ITR form Number’ as ITR-1

– Select ‘Filing Type’ as ‘Original/Revised Return’

– Click on “Continue”

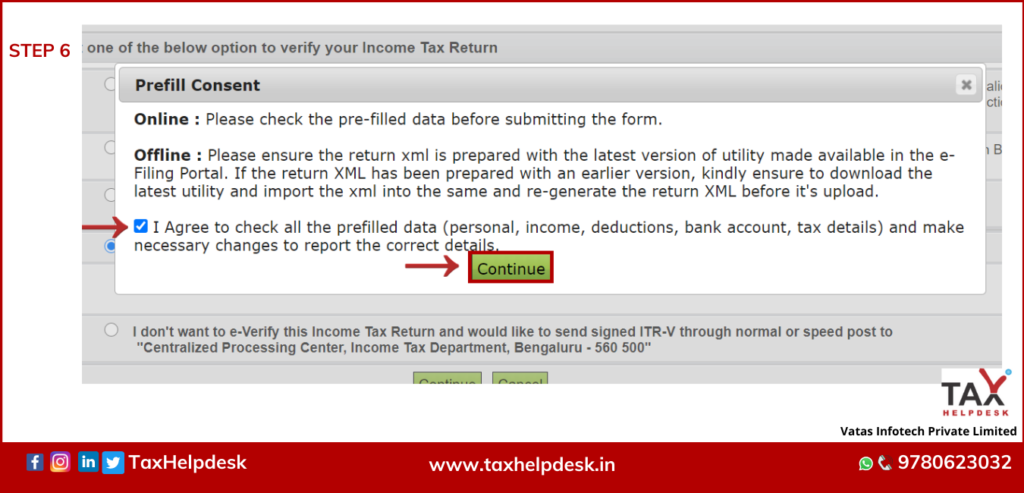

Step 6: Agree to the “prefill consent” and click on “Continue”

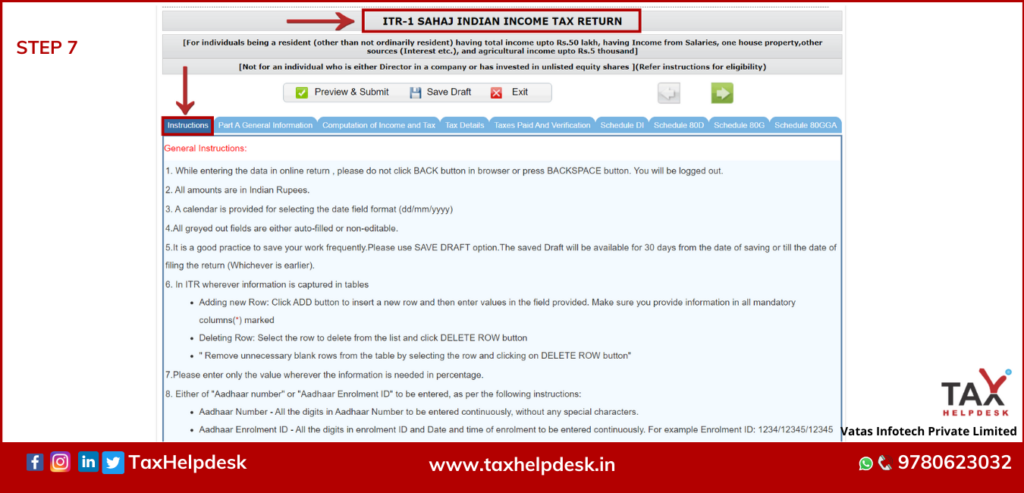

Step 7: Read the Instructions carefully and Fill all the applicable and mandatory fields of the Online ITR Form.

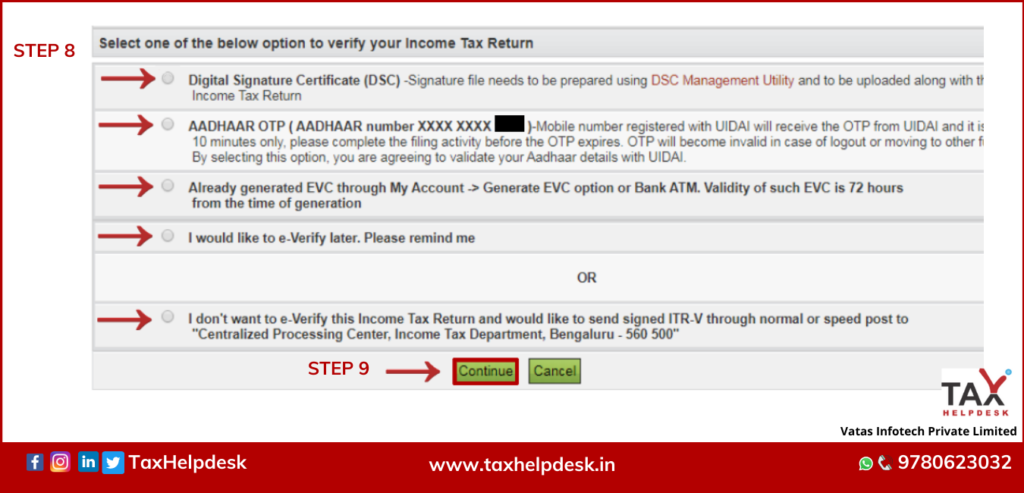

Step 8: Choose any one of the following option to verify the Income Tax Return:

– Digital Signature Certificate (DSC).

– Aadhaar OTP.

– EVC using Prevalidated Bank Account Details.

– EVC using Prevalidated Demat Account Details.

– Already generated EVC through My Account à Generate EVC Option or Bank ATM. Validity of such EVC is 72 hours from the time of generation.

– I would like to e-Verify later. Please remind me.

– I don’t want to e-verify this Income Tax Return and would like to send signed ITR-V through normal or speed post to “Centralized Processing Center, Income Tax Department, Bengaluru – 560500”

Step 9: Click on “Continue”.

Step 10: Click on ‘Preview and Submit’ button. Verify all the data entered in the ITR.

Step 11: ‘Submit’ the ITR.

Step 12: On Choosing ‘I would like to e-Verify’ option, e-Verification can be done through any of the following methods by entering the EVC/OTP when asked for.

– EVC generated through bank ATM or Generate EVC option under My Account

– Aadhaar OTP

– Prevalidated Bank Account

– Prevalidated Demat Account

Note:

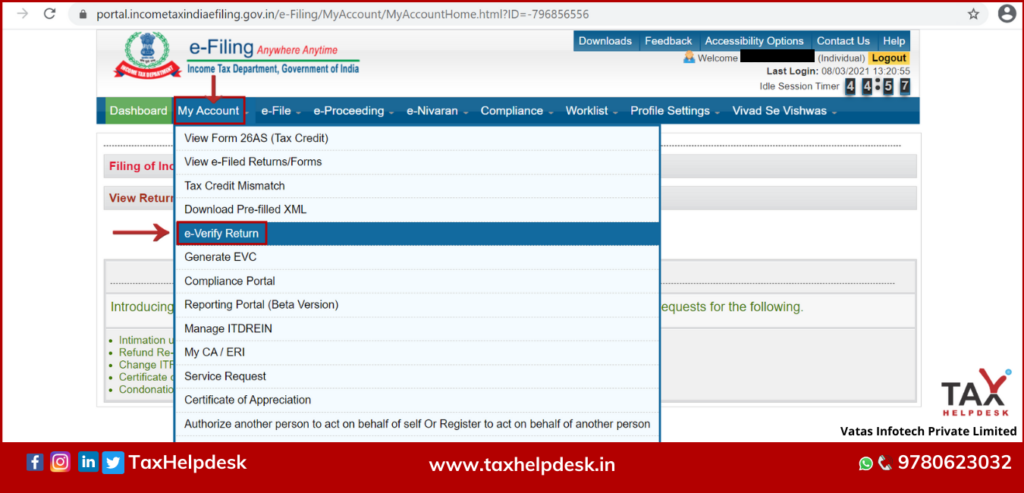

On Choosing the other two verification options, the ITR will be submitted but the process of filing the ITRs is not complete until it is verified. The submitted ITR should be e-Verified later by using ‘My Account > e-Verify Return’ option or the signed ITR-V should be sent to CPC, Bengaluru.

The EVC/OTP should be entered within 60 seconds else, the Income Tax Return (ITR) will be auto-submitted.

Follow these steps to file your Income Tax Return online or contact us at TaxHelpdesk to know more!

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

Pingback: Can I claim HRA even if I’m staying at my parents’ house? | TaxHelpdesk