Mutual fund taxation is dependent on two factors namely: type of the mutual fund and duration of the mutual fund.

There is a well-known proverb that the person should not put all the eggs in one basket and this still holds true. The person should not rely on only one type of investment. Accordingly, one should invest in various plans and funds.

In the current changing scenario, mutual funds are one of the most emerging and promising funds. And, one can invest in these mutual funds through SIP or lumpsum amounts.

Now, read this blog to know about taxation on Mutual Funds SIP.

Before knowing the Mutual Fund taxation, one should know the following questions:

What is Mutual Funds SIP?

Mutual Funds SIP is a Systematic Investment Planning method for investing in mutual funds. The investor through investing by way of SIP has an option to choose the frequency of the investment. Consequently, this frequency can be weekly/monthly/quarterly/bi-annually/annually.

Also Read: 10 ways to save your taxes!

Mutual Funds Taxation

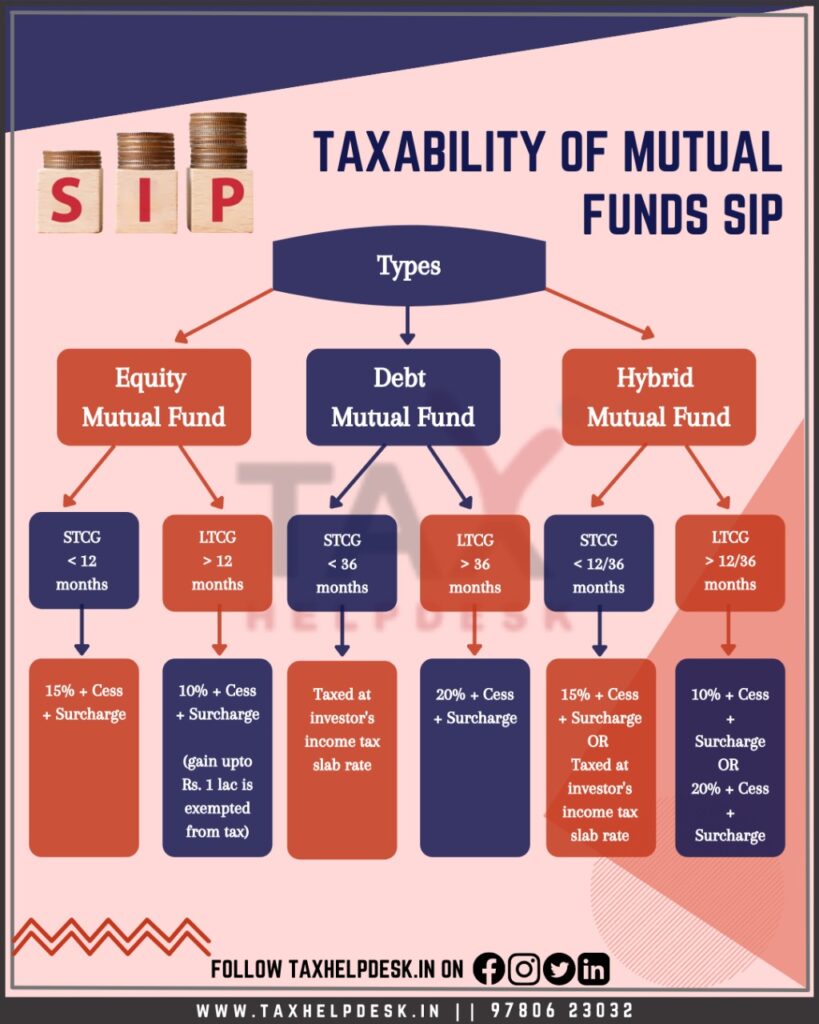

Mutual fund taxation is dependent on two factors:

– Type of Mutual Fund

– Duration of Mutual Fund

Types of Mutual Funds

For purposes of investment and mutual fund taxation, the Mutual Funds are of three types:

Firstly, Equity Mutual Funds:

Equity Mutual funds are those mutual funds that are primarily invested in the stock market. And, on investing in these types of funds, money is invested in equity stocks on behalf of the person and consequently, a portfolio is created. Accordingly, profits or losses in this portfolio affect the person’s Net Asset Value (NAV). These equity mutual funds have further classifications as per various types of funds, namely:

– Small-Cap Equity Funds

– Mid-Cap Equity Funds

– Large-Cap Equity Funds

– Large & Mid-Cap Equity Funds

– Multi-Cap Equity Funds

Note:

Equity mutual funds are those mutual funds whose portfolio’s equity exposure exceeds 65%.

Secondly, Debt Mutual Funds:

Debt Mutual Funds are schemes that invest in fixed-income instruments, such as Corporate and Government Bonds, corporate debt securities, money market instruments, etc. that offer capital appreciation. Having said this, these funds are also referred to as Fixed Income Funds or Bond Funds. And, the investment in these funds is in a variety of securities, on the basis of their credit ratings. The higher the credit rating is, the less volatile it will be. Apart from this, just like equity mutual funds, these debt mutual funds have further classifications into the following types:

– Liquid Fund

– Money Market Fund

– Dynamic Bond Fund

– Gilt Fund

– Long Duration Fund

Lastly, Hybrid Mutual Funds:

Hybrid mutual funds are a combination of the above two mutual funds i.e., Equity Mutual Funds and Debt Mutual Funds. Accordingly, these funds try to create a balancing portfolio to offer regular income to its investors along with capital appreciation. Therefore, the hybrid mutual funds can be either

– Hybrid Equity oriented funds, or

– Hybrid Debt oriented funds

Also Read: How to treat income from transfer of shares

Duration of mutual fund

The duration of a mutual fund is divided into two types:

– Short Term Mutual Fund

– Long Term Mutual Fund

The bifurcation of mutual funds based on the basis of duration is as follows:

| Mutual Fund Type | Short-term capital gains | Long-term capital gains |

|---|---|---|

| Equity Mutual Funds | Shorter than 12 months | 12 months and longer |

| Debt Mutual Funds | Shorter than 36 months | 36 months and longer |

| Hybrid equity-oriented Mutual Funds | Shorter than 12 months | 12 months and longer |

| Hybrid debt-oriented Mutual Funds | Shorter than 36 months | 36 months and longer |

Taxability of Mutual Fund SIP on basis of Type and Duration

The taxability of mutual fund SIP on the basis of type and duration is as follows:

| Mutual Fund type | Short-term capital gains | Long-term capital gains |

|---|---|---|

| Equity Mutual Funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

| Debt Mutual Funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

| Hybrid equity-oriented Mutual Funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

| Hybrid debt-oriented Mutual Funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

Note:

In the case of investment in mutual funds through SIP, each instalment is considered a fresh instalment. Therefore, the holding period of each instalment is calculated.

Illustration 1

Shilpa started a monthly SIP in an equity scheme on 1st January, 2019. And, on 2nd January, 2020 she decided to redeem the entire investment.

In this case, only capital gains on the units purchased from Shilpa’s first instalment (invested on 1st January 2019) will be long-term capital gains as the holding period was more than one year. On the other hand, for the remaining units, the holding period is lower than one year. Hence, the gains will be taxable as per short-term capital gains rates.

Illustration 2

| Name | Other Income | Type of Mutual Fund | Investment Period | SIP Amount | Capital Gain | Tax Applicable | Reasons |

|---|---|---|---|---|---|---|---|

| Rekha | 1,00,000 | Equity Mutual Fund | 1st Jan, 2019 – 1st Dec, 2019 | Rs. 10,000 | Rs. 50,000 | Rs. 7,800 [15% + Cess + Surcharge) | Since Rekha has invested for less than 12 months, the income will be classified as short term capital gains. |

| Jaya | 1,00,000 | Equity Mutual Funds | 1st Jan, 2019 – 1st March, 2020 | Rs. 10,000 | Rs. 90,000 | 0 | Since Jaya has invested for more than 12 months, income will be classified as long term capital gain. However, the long term capital gains of up to Rs. 1 lakh are exempted from tax. |

| Sushma | 1,00,000 | Debt Mutual Funds | 1st Jan, 2019 – 1st Dec, 2019 | Rs. 10,000 | Rs, 50,000 | 0 (Income below Rs. 2,50,000) | Sushma has invested in debt mutual funds for less than 36 months. Therefore, it is short term capital gain and tax liability will be calculated as per income tax slab rate. |

| Nirma | 1,00,000 | Debt Mutual Funds | 1st Jan, 2019 – 1st May, 2022 | Rs. 10,000 | Rs. 90,000 | Rs. 18,720 | Nirma has invested in debt mutual funds for more than 36 months. Accordingly, tax on long term capital gains will be calculated |

FAQs

The person can claim deductions under Section 80C by investing in mutual funds. However, such mutual fund must be an Equity Linked Savings Scheme plan. The total savings under 80C that qualifies for deduction is Rs.1.5 lakhs (max).

Yes, ELSS comes with a locking period of 3 years. The investor can’t redeem the units before 3 years.

Mutual funds work as well as per the scenario in the market. Therefore, Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

If you want to know more about Mutual Funds or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: All you need to know about Annual Information Statement | TaxHelpdesk

Pingback: Taxability of Capital Assets in India | TaxHelpdesk

Pingback: Know About Systematic Investment Plan (SIP) | TaxHelpdesk