The PAN Card details can be updated through filling of Form 49A. This can be done through process online or offline procedure. There are two PAN issuing authorities in India – NSDL and UTIISL. The process for updating of PAN Card from both of these the authorities is same.

What is PAN?

Permanent Account Number, majorly knows as PAN to many of us, is an essential legal document not just for filing Income Tax Returns but also for works for various other purposes like

– Identity Proof

– Claiming tax deductions

– Claiming income tax refund

– For starting a new business

– For opening a bank account

– Opening of demat account

– Purchase and sale of immovable property

– Paying bills and depositing cash in bank above Rs. 50,000/, and many more

Also Read: Do I need to file Income Tax Returns?

Who can obtain a PAN Card?

| Particulars | Description |

|---|---|

| Income is above the basic exemption limit | Every person if his total income or the total income of any other person in respect of which he is assessable during the year exceeds Rs. 2,50,000. |

| Business or Profession | Every person who is carrying on any business or profession whose total sales, turnover, or gross receipts are or is likely to exceeds Rs. 5 lacs in any year |

| Non-Individual Resident Persons | Every non-individual resident persons and persons associated with them shall apply for PAN if the financial transaction entered into by them during the financial year exceeds Rs. 2,50,000. |

| Specified financial transactions | Every person who intends to enter into specified financial transactions in which quoting of PAN is mandatory |

| Charitable Trust | A charitable trust who is required to furnish return under Section 139(4A) |

What are the details on PAN Card?

PAN Card comprises of

– 10 digit unique alphanumeric number

– First Name

– Middle Name

– Surname

– Father’s Name

– Date of birth

– Card holder’s signature

– Card holder’s photo

Note: In case of individuals only, the details such as father’s name and date of birth are provided on PAN. The date of incorporation in place of date of birth is provided for applicants other than individuals.

Reasons for updating the details of PAN Card

There can be various reasons for which an applicant may need to go for updating the details in PAN like:

– Mismatch in details on Aadhaar card and PAN card.

– Change of name of the applicant

– Change of address of the applicant

– Change of citizenship status of the applicant, and many more.

Steps to update details on PAN Card Online are as follows:

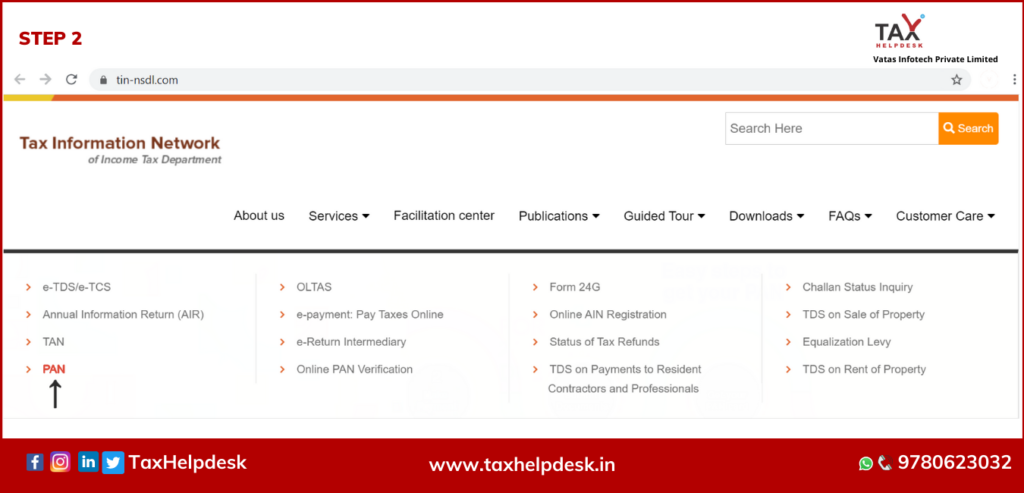

Step 1: Visit the official website of NSDL, Tax Information Network or UTIITSL.

Step 2: Go to “Services” and click on “PAN”

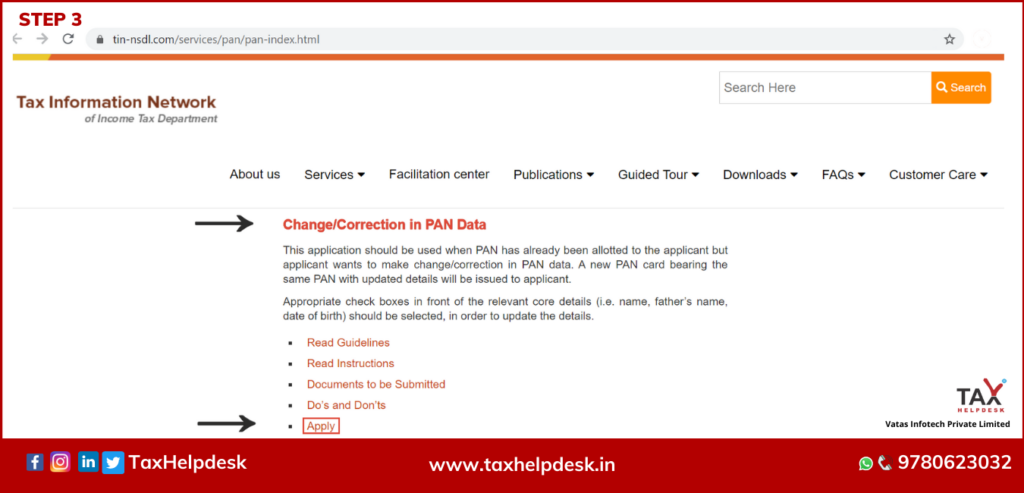

Step 3: Head over to the category “Change/Correction in PAN Date” and click on “Apply”

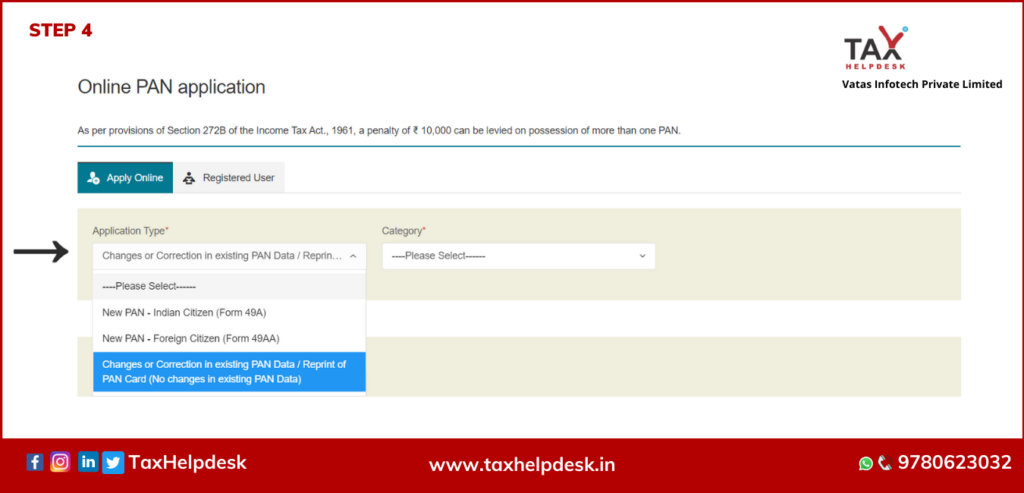

Step 4: From the ‘Application Type’ dropdown menu, select ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’.

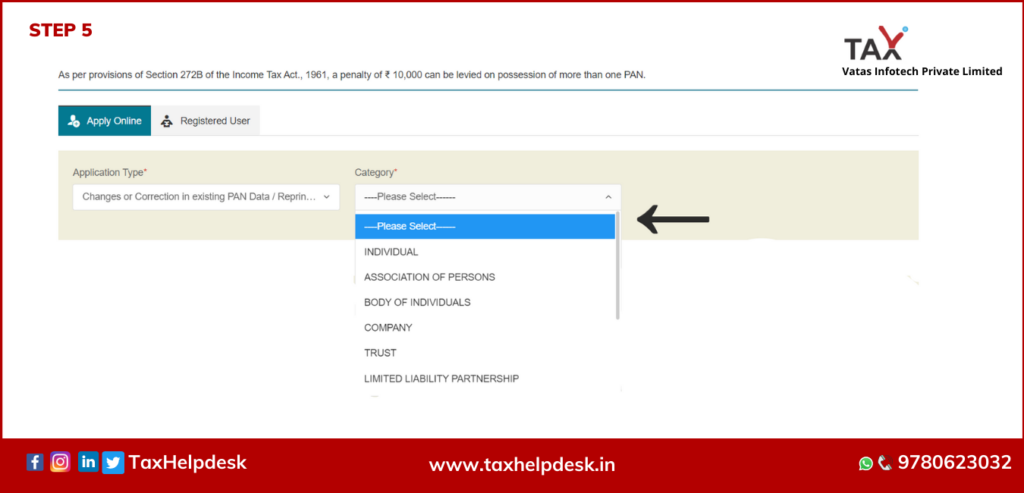

Step 5: From the ‘Category’ dropdown menu, select the correct category of the assessee, For example, if the PAN is registered in assessee’s personal name, then category ‘Individual’ is to be selected from the list.

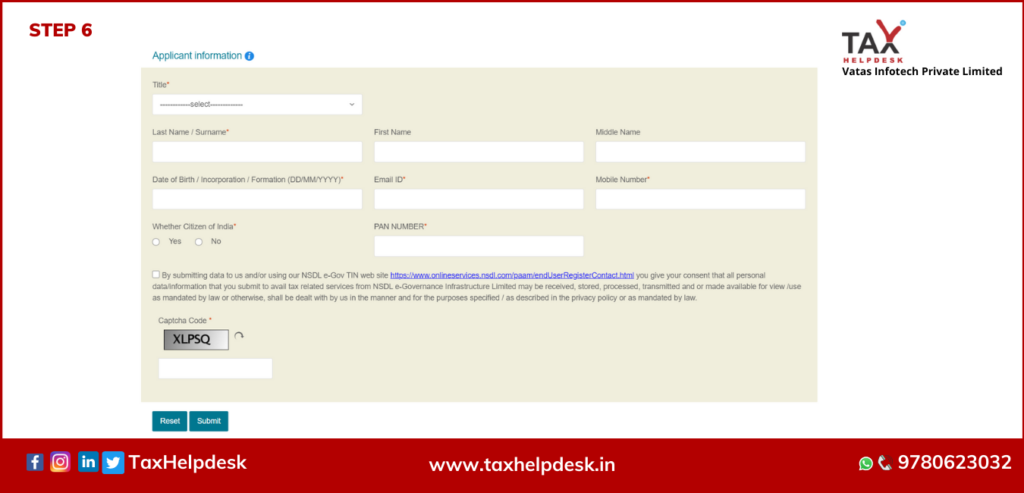

Step 6: Now, enter the remaining details – title, last name, date of birth (if applicable), email id, mobile number, citizenship status and PAN number.

Step 7: Enter the captcha code and click on “Submit”

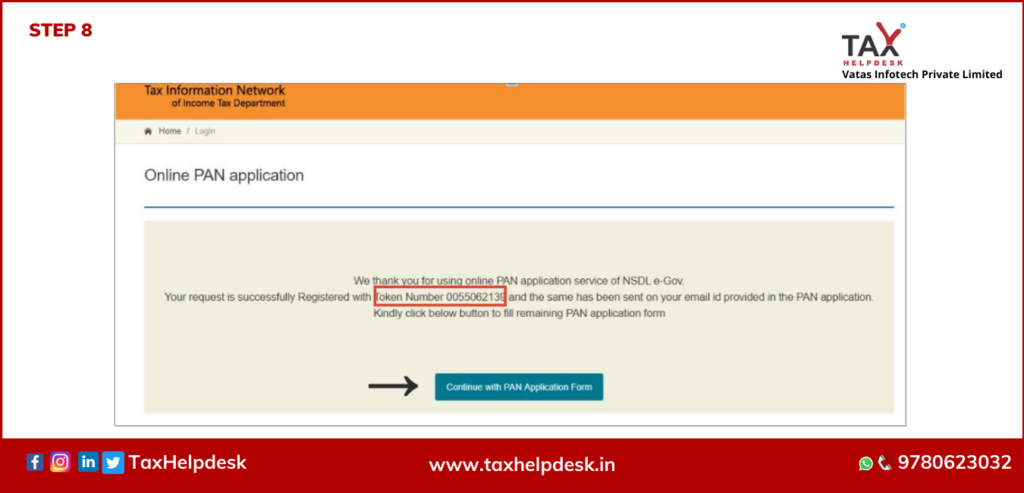

Step 8: On submission, a Token Number will be sent on the email address provided by the applicant. The applicant is then directed to “Continue with PAN Application Form”

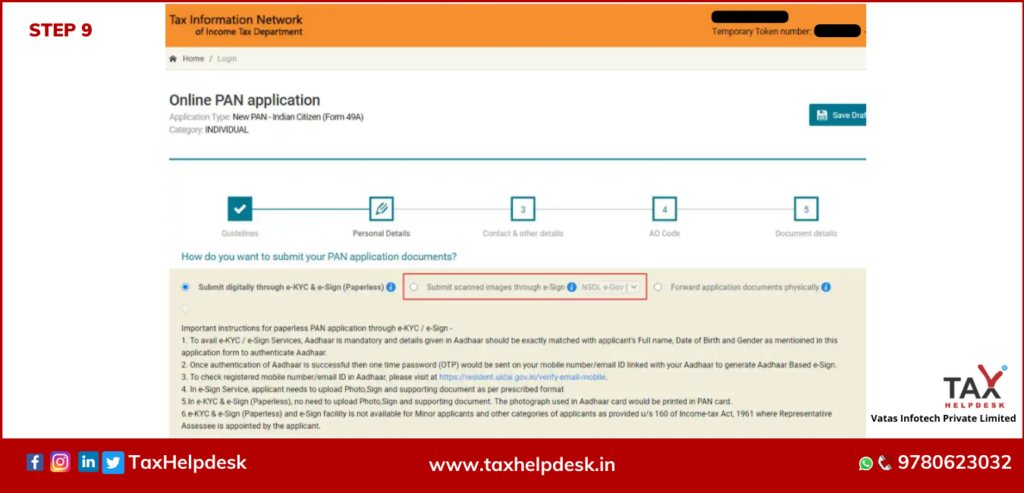

Step 9: After clicking on “Continue with PAN Application Form”, the applicant will be given three options to submit the PAN application documents. Click on “Submit scanned images through e-scan”

Step 10: Fill the remaining required details – father’s name, mother’s name (optional), Aadhaar number and click on next.

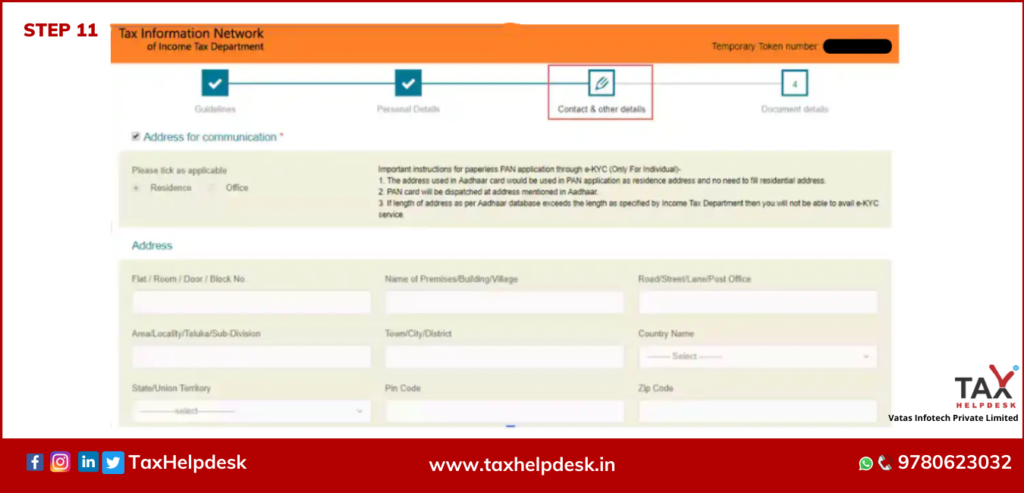

Step 11: The applicant will now be redirected to the window wherein, he can update his address.

Step 12: Upload all the necessary documents such as proof of address, proof of age, proof of identity and PAN.

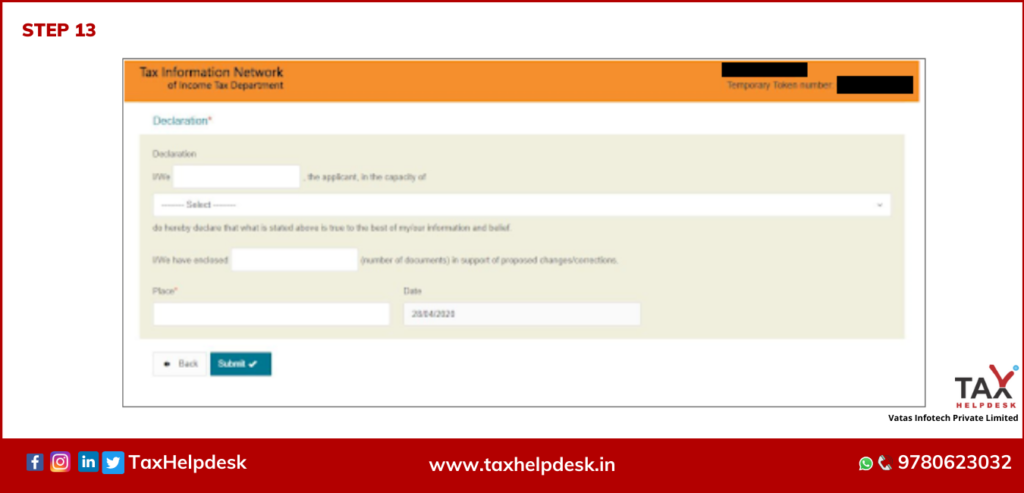

Step 13: Fill in the details required in “Declaration” and click on “Submit”

Step 14: The applicant will now be redirected to the “Payment” page. Payment can be made through demand draft, net banking, and Credit card/Debit card.

Step 15: On successful payment, an acknowledgement slip will be generated. The applicant should take a print of it and send it to the NSDL e-gov office along with the physical proof of documents. Also, affix a photograph in the space provided and sign across it. Write ‘Application for PAN Change’ on top of the envelope along with the acknowledgement number. The mailing address of NSDL is:

NSDL e-Gov at Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016′

Updated PAN card is generally sent to the applicant within 45 working days from the submission of the acknowledgment slip.

Steps to update details on PAN Card Offline are as follows:

Step 1: Visit the website of NSDL

Step 2: Download the form “Request for New PAN Card Or/ And Changes Or Correction in PAN Data” or Click here to download

Step 3: Read all the instructions carefully before filling the form

Step 4: Fill all the mandatory details in the form carefully

Step 5: Attach all the supporting documents such as proof of identity, proof of address, proof of date of birth and passport size photographs.

Step 6: Submit the form at the nearest NSDL Centre. Check your Nearest NSDL Centre here!

Step 7: Make payment for updating details on PAN Card

Step 8: A 15-digit acknowledgement number to track the status of the PAN shall be received by the applicant on submission of the document and payment of fees.

Step 9: This acknowledgement number slip is to be sent to the Income Tax PAN Service Unit of NSDL

Step 10: A letter regarding the request for updates in PAN Card must also be jurisdictional Assessment Officer.

Please note that the details required in online and offline process for updating the details of PAN Card are same. The acknowledgement slip in both the process, must reach the office of NSDL within 15 days from receiving the acknowledgment slip.

Follow these steps to update your PAN Card or simply contact us at TaxHelpdesk.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!