In order to provide relief and lessen the burden on small taxpayers, the tax rebate scheme was introduced by the government. This was done through insertion of Section 87A in the Income Tax Act.

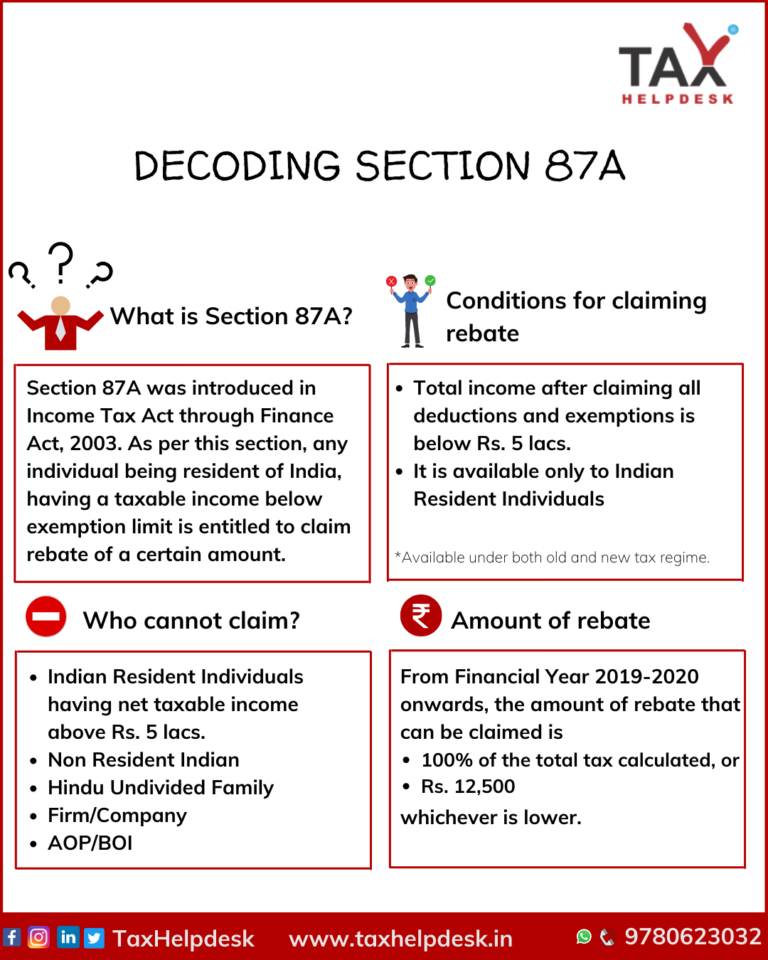

Decoding Section 87A

Section 87A was introduced in Income Tax Act through the Finance Act, 2003. It states that any individual being a resident of India, having a taxable income below the exemption limit is entitled to claim a rebate of a certain amount.

Also Read: 10 Ways To Save Your Taxes!

Criteria To Avail The Rebate Under Section 87A

Any Indian Resident individual whose income lies below Rs 5,00,000 is eligible to claim a tax amount rebate under this section. The amount of tax rebate can be either 100% of the total tax amount calculated of his total income or Rs 12500, whichever is lower.

Also Read: Income Tax Slab Rates For Individuals Under The Old And New Tax Regime

important note

Until the Financial Year 2018-2019, the maximum tax rebate limit was ₹2,500 for individuals with net taxable income below Rs. 3.5 lacs. Through the Union Budget, 2019, the government further hiked the net taxable income to Rs. 5 lacs. In addition to this, the maximum limit was raised to Rs. 12,500.

Eligibility for Section 87A

To claim rebate under Section 87A one should:

– Be a resident individual taxpayer of India

– Hold total income after deducting eligible deductions under Section 80C to Section 80U, below the total exemption limit i.e., below ₹5 lacs.

Also Read: All About Advance Tax Under Income Tax Act

important Note

The rebate shall

– Firstly, be available on an amount of tax calculated before adding any Education or related cess.

– Secondly, be available to only an Individual & not to any Firm/Company/HUF.

– Thirdly, be available to Senior citizens above 60 years opting for old tax regime

– Fourthly, is not available to super senior citizens aged above 80 years and opting for old tax regime.

– Lastly, is available under both the old tax regime and new tax regime.

Adjustment Of Tax Liability Against Rebate

This rebate can be claimed against the tax liability in respect of normal income which is taxed at the slab rate, long term capital gains under Section 112 of the Income Tax Act. This rebate is also available against the tax liability for short term capital gains on listed equity shares as well as equity-oriented schemes of mutual funds under Section 111A of the Act.

Also Read: Tax Benefits On Health Insurance And Medical Expenditures

Form for section 87A

To claim rebate, one has to put the value of the tax amount in the column Rebate under Section 87A. This has to be mentioned while filing the Income tax return under any respective ITR form, ITR 1, ITR 2 , ITR 4 etc.

Also Read: Which ITR should I file?

Illustration

| Net Taxable Income | Tax Amount in AY 2019-20 | Tax Amount in AY 2022-23 / 2023-24 | Eligible for Rebate under Section 87A for AY 2019-2020 | Eligible for Rebate under Section 87A for AY 2022-2023 / AY 2023-24 | Rebate in AY 2019-2020 | Rebate in AY 2022-2023 / 2023-2024 |

|---|---|---|---|---|---|---|

| Rs. 2,70,000 | Rs. 2,000 | Rs. 2,000 | Yes | Yes | Rs. 2,000 | Rs. 2,000 |

| Rs. 3,20,000 | Rs. 5,000 | Rs. 5,000 | Yes | Yes | Rs. 2,500 | Rs. 5,000 |

| Rs. 3,68,000 | Rs. 2,700 | Rs. 5,000 | No | Yes | 0 | Rs. 5,000 |

| Rs. 4,89,000 | Rs. 12,000 | Rs. 12,000 | No | Yes | 0 | Rs. 12,000 |

| Rs. 5,00,000 | Rs. 12,500 | Rs. 12,500 | No | Yes | 0 | Rs. 12,500 |

| Rs. 6,00,000 | Rs. 20,000 | Rs, 20,000 | No | No | 0 | 0 |

If you want to know more about tax rebates or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: 10 Ways to Save Your Taxes! | TaxHelpdesk

Pingback: Do I need to File Income Tax Returns? | TaxHelpdesk