Financial Year is different from the Assessment Year. Most of the assessees think that the Financial Year and Assessment Year are one of the same things, but they both are not the same.

Meaning of Financial Year and Assessment Year

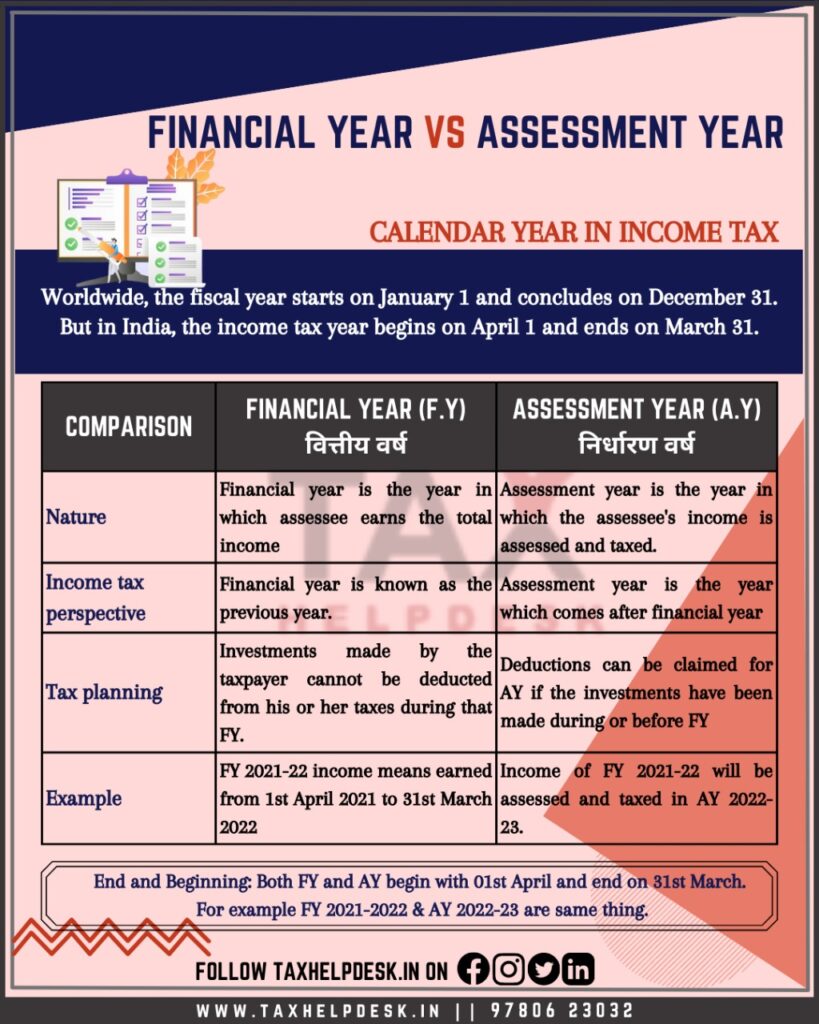

Financial Year is the year in which the assessee earns the total income. On the other hand, the Assessment Year is the year which comes after the Financial Year.

Both terms in Hindi

Financial Year in Hindi is known as वित्तीय वर्ष and Assessment Year in Hindi is known as निर्धारण वर्ष.

Also Read: 7 Reasons why you should file your Income Tax Return?

Income Tax Perspective

As per the Income Tax Act, Financial Year is the year in which the income is earned and is known as Previous Year for the purpose of taxation and the Assessment Year is the year in which the income is assessed and taxed.

The purpose behind distinction between Financial and Assessment Year under the Income Tax Act is that the Income cannot be taxed before it is earned. The tax can be calculated on income only when it has been earned. The income earned during the Financial Year is assed and taxed in the Assessment Year. Therefore, the assessees have also to select their Assessment Year before filing of their Income Tax Returns.

Also Read: Best ways to save your taxes in 2024

Tax planning

The assessee cannot claim any deductions or save taxes through investments made in the same financial year. The investments made in the FY can be used in saving taxes only in its AY.

For instance, Ram invests in LIC policy in the FY 2024-2025. He can claim deduction under Section 80C only in the AY 2025-2026 i.e., the year in which his income will be assessed and taxed.

Also Read: Ways to save tax other than Section 80C

Examples

| Financial Year | Assessment Year | Financial Year |

|---|---|---|

| 2020-2021 | 2021-2022 | 2020-2021 |

| 2021-2022 | 2022-2023 | 2021-2022 |

| 2022-2023 | 2023-2024 | 2022-2023 |

| 2023-2024 | 2024-2025 | 2023-2024 |

| 2024-2025 | 2025-2026 | 2024-2025 |

Conclusion

– Financial Year 2024-2025 income means income earned from 1st April, 2024 to 31st March, 2025.

– Income of Financial Year 2024-2025 will be assessed and taxed in Assessment Year 2025-2026.

– Both FY & AY, begin on 1st April & end on 31st March.

– Therefore, FY 2023-2024 & AY 2024-2025 are the same things.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram, Twitter and Linkedin!

Pingback: Deductions on interest earned by Senior Citizens | Section 80TTB | TaxHelpdesk

Pingback: Deduction on Electrical Vehicle for Interest Paid on Loan | TaxHelpdesk

Pingback: Do’s and Don’ts of filing Income Tax Return | TaxHelpdesk

Pingback: Income Tax Slab rates For Individuals under the Old and New Tax Regime | TaxHelpdesk

Pingback: Which Section is applicable – Section 194Q or Section 206C(1H)? | TaxHelpdesk

Pingback: Do I need to File Income Tax Returns? | TaxHelpdesk

Pingback: TDS on Cash Withdrawal From Bank in a Financial Year | TaxHelpdesk

Pingback: GST Compliance Calendar: July, 2021 | TaxHelpdesk

Pingback: Extension of due dates due to COVID-19 | TaxHelpdesk

Pingback: New Rules Related to Employee Provident Fund Scheme | TaxHelpdesk

Pingback: Income Tax on Income of Minor Child | TaxHelpdesk

Pingback: All about Advance Tax under Income Tax Act | TaxHelpdesk

Pingback: Penalty for Not filing ITR on Time (Section 234F) | TaxHelpdesk

Pingback: Meaning, Types, Treatment of Dearness Allowance | TaxHelpdesk

Pingback: How to opt for QRMP Scheme under GST | TaxHelpdesk

Pingback: Tax Saving Fixed Deposit : 12 Things you should know | TaxHelpdesk

Pingback: Avoiding Mistakes & Errors while filing Income Tax Return | TaxHelpdesk

Pingback: Income Tax Audit: Small Taxpayers or Presumptive Income | TaxHelpdesk

Pingback: Can I file Income Tax Return after 31st December, 2021? | TaxHelpdesk

Pingback: Cases in which Tax relief can be obtained under Section 89(1) | TaxHelpdesk