Income Tax Slab FY 2024-2025 rates under the Income Tax Act help in calculating the tax liability on the income of the person. Having said this, these slab rates are different under the Old Tax Regime and the New Tax Regime.

What is an Income Tax Slab FY 2024-2025?

Income Tax Slab FY 2024-2025 is a system wherein there is an assignment of different tax rates against the different income ranges. Further, the slab rates increase as the income of the person increases. This is because, in India we follow a progressive system and so, the tax rate increases with the increase in the income.

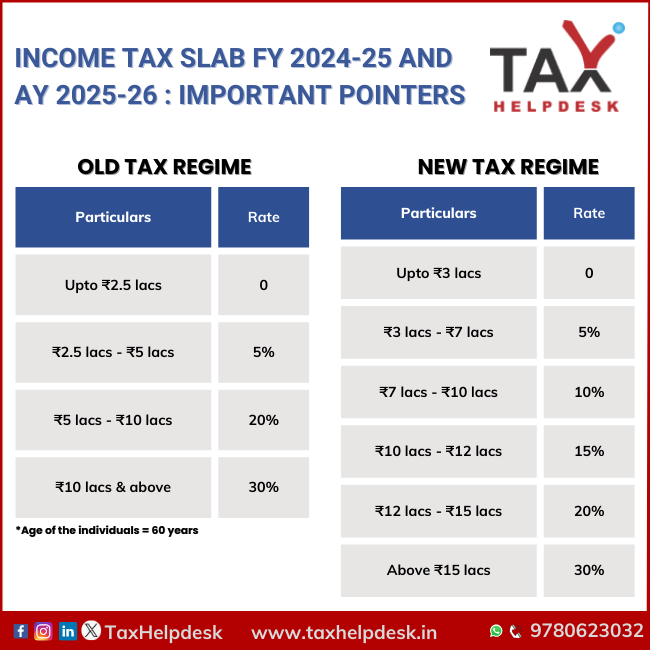

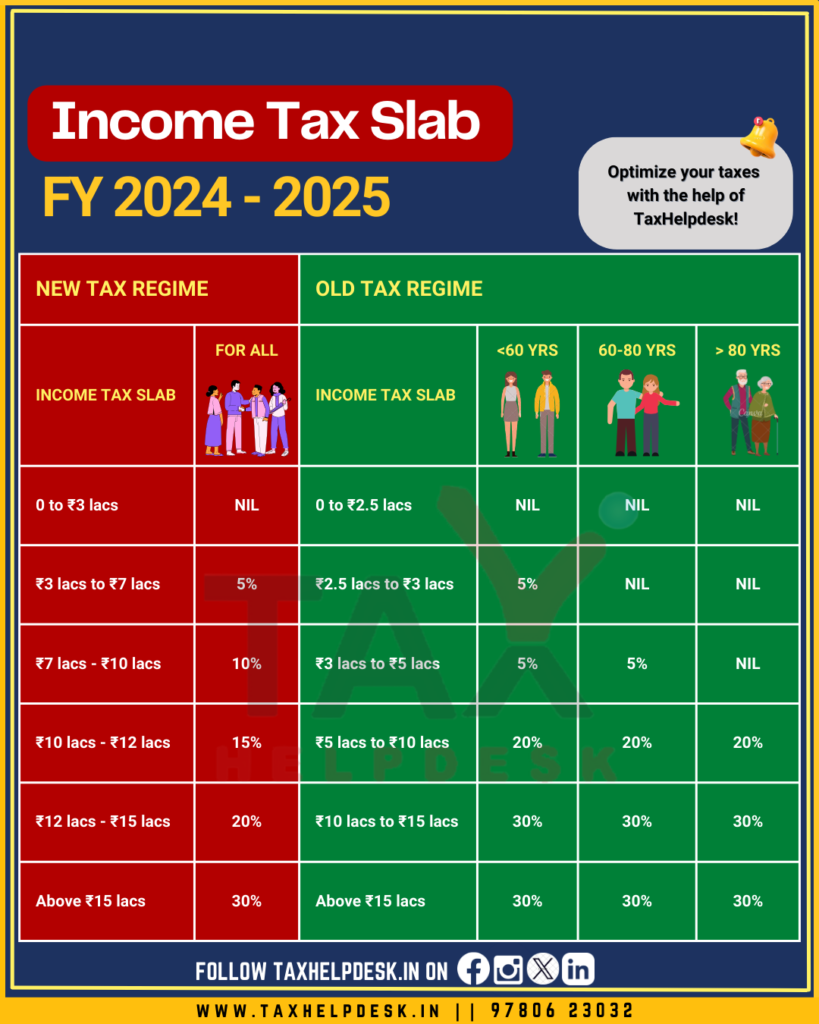

Income Tax Slab Rates under the Old Tax Regime

The Income Tax Slab rates under the Old Tax Regime are classified into three parts based on age and income of the person. These are as follows:

– Indian Residents above 60 years + All the non-residents

– 60 to 80 years: Resident Senior citizens

– More than 80 years: Resident Super senior citizens

Also Read: Exemptions, Allowances, and Deductions under the Old & New Tax Regime

Income Tax Slab Rates under the Old Tax Regime FY 2024-2025 (AY 2025-2026)

| Income Tax Slab | Individuals Age (Below 60 years) | Resident Senior Citizens (Age is between 60 – 80 years) | Resident Super Senior Citizens (80 years and above) |

|---|---|---|---|

| 0 to ₹2.5 lacs | NIL | NIL | NIL |

| ₹2.5 lacs to ₹3 lacs | 5% | NIL | NIL |

| ₹3 lacs to ₹5 lacs | 5% | 5% | NIL |

| ₹5 lacs to ₹10 lacs | 20% | 20% | 20% |

| Above ₹10 lacs | 30% | 30% | 30% |

New Tax Regime Slab Rates FY 2024-2025 (AY 2025-2026)

Through the Union Budget 2024, there has been a revision in the Income Tax Slab rates under the New Tax Regime. Under the new tax regime, the taxpayers can save Rs. 17,500 more in taxes. In addition to this, there is also an increase in standard deduction from Rs. 50,000 to Rs. 75,000. And, not only this, there is also an increase in family pension deduction from Rs. 15,000 to Rs. 25,000. The comparison of tax slab rates under the new tax regime between the pre and post Union Budget are as follows:

| Tax Slab for FY 2023-24 | Tax Rate | Tax Slab for FY 2024-25 | Tax Rate |

|---|---|---|---|

| Upto ₹ 3 lakh | Nil | Upto ₹ 3 lakh | Nil |

| ₹ 3 lakh – ₹ 6 lakh | 5% | ₹ 3 lakh – ₹ 7 lakh | 5% |

| ₹ 6 lakh – ₹ 9 lakh | 10% | ₹ 7 lakh – ₹ 10 lakh | 10% |

| ₹ 9 lakh – ₹ 12 lakh | 15% | ₹ 10 lakh – ₹ 12 lakh | 15% |

| ₹ 12 lakh – ₹ 15 lakh | 20% | ₹ 12 lakh – ₹ 15 lakh | 20% |

| More than 15 lakh | 30% | More than 15 lakh | 30% |

Also Read: Tax Rebate under the Old & New Tax Regime

Comparision of Income Tax Slab Rates under the Old and New Tax Regime Over the years

| Old Tax Regime (FY 2022-23, FY 2023-24 and FY 2024-25) | New Tax Regime | |||||

| Income Tax Slabs | Below 60 years | Between 60-80 years | Above 80 years | FY 2022-23 | FY 2023-24 | FY 2024-25 |

| Up to ₹2,50,000 | NIL | NIL | NIL | NIL | NIL | NIL |

| ₹2,50,001 – ₹3,00,000 | 5% | NIL | NIL | 5% | NIL | NIL |

| ₹3,00,001 – ₹5,00,000 | 5% | 5% | NIL | 5% | 5% | 5% |

| ₹5,00,001 – ₹6,00,000 | 20% | 20% | 20% | 10% | 5% | 5% |

| ₹6,00,001 – ₹7,00,000 | 20% | 20% | 20% | 10% | 10% | 5% |

| ₹7,00,001 – ₹7,50,000 | 20% | 20% | 20% | 10% | 10% | 10% |

| ₹7,50,001 – ₹9,00,000 | 20% | 20% | 20% | 15% | 10% | 10% |

| ₹9,00,001 – ₹10,00,000 | 20% | 20% | 20% | 15% | 15% | 10% |

| ₹10,00,001 – ₹12,00,000 | 30% | 30% | 30% | 20% | 15% | 15% |

| ₹12,00,001 – ₹12,50,000 | 30% | 30% | 30% | 20% | 20% | 20% |

| ₹12,50,001 – ₹15,00,000 | 30% | 30% | 30% | 25% | 20% | 20% |

| ₹15,00,000 and above | 30% | 30% | 30% | 30% | 30% | 30% |

Slab Rates for Domestic Companies

| Particulars | Old regime Tax rates | New Regime Tax rates |

|---|---|---|

| Company opts for section 115BAB (not covered in sections 115BA and 115BAA) & is registered on or after October 1, 2019, and has commenced manufacturing on or before 31st March 2024 and subject to the conditions specified in the section.Applicable from AY 2020-21 and onwards. | – | 15% |

| Company opts for Section 115BAA, wherein the total income of a company has been calculated without claiming specified deductions, incentives, or exemptions and additional depreciation as specified in the section.Applicable from AY 2020-21 and onwards. | – | 22% |

| The company opts for section 115BA registered on or after March 1, 2016 and engaged in the manufacture of any article or thing and does not claim the deduction as specified in the section.Applicable from AY 2017-18 and onwards. | – | 25% |

| Turnover or gross receipt of the company is less than Rs. 400 crore in the previous year 2020-21 | 25% | 25% |

| Any other domestic company | 30% | 30% |

Income Tax Slab Rates for Partnership Firms

A partnership firm/ LLP is taxable at 30% irrespective of its income slab.

Income Tax Slab Rates for HUFs

The income tax slab rates applicable to HUFs are the same as the income tax slab rates applicable to individuals.

If you want to plan your taxes, then you must act now and optimize your taxes with the help of TaxHelpdesk. Also, do not forget to follow us on Facebook, Instagram, LinkedIn and Twitter.