Like Income Tax Notices, under the GST laws also, the notices are sent to taxpayers to not only inform them about their tax defaults. It also send them the reminders of caution for any default that has been noticed by the GST Department. Furthermore, the notices can be sent to taxpayers if any information is require from them by the Department. These notices can be issue from the Department in form of Show Cause Notice (SCN), Demand Notice and Scrutiny Notice. There are also other related form of notices.

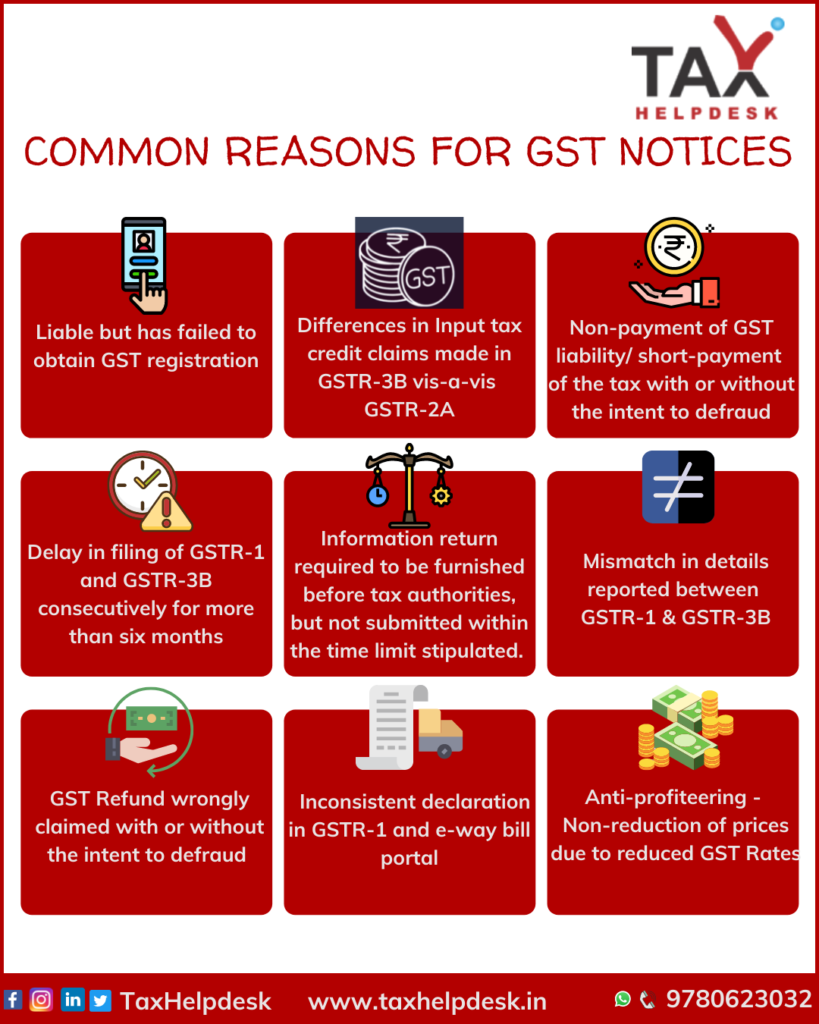

Common Reasons for GST Notices

Most of the times, the GST Notices are issue for the following reasons.

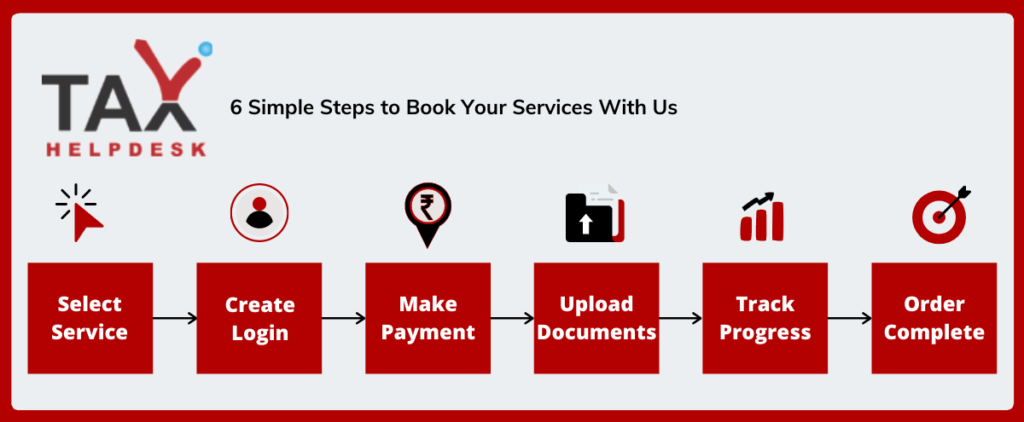

Get in touch with TaxHelpdesk to Resolve your case

Once you have apply these steps and placed your service request for reply to GST Notices. Our experts at TaxHelpdesk will get in touch with you in 24 working hours.

Types of Notices under GST:

Notices under GST are issue to the taxpayers, depending upon the purpose or gravity of default or action require from these taxpayers. In addition, following is the list of Notices issue under the GST laws.

Name of Notice Form | Description of Notice | Response Required | Time Limit for Response | Consequences of No Response |

GSTR-3A | Default notice for taxpayers who don’t not file their GST returns they are in GSTR-1, GSTR-3B, GSTR-4, or GSTR-8 | File the require GST returns along with late fees interest on the GST liability (if any) | 15 days from the date of receiving of the notice | Assessment of tax to the best judgement by using the available information. |

Assessment of tax to the best judgement by using the available information. | ||||

In addition, applicable penalty of Rs. 10,000, or 10% of the due GST, whichever is more. | ||||

CMP-05 | Show Cause Notice (SCN) questioning the taxpayers eligibility to be a composition dealer | Reasons must provide in CMP-06, justifying the taxpayers eligibility it is for the composition scheme | 15 days from the date of receiving the notice | Penalty as per Section 122 and an order in CMP-07 denying benefits of the composition scheme to the taxpayer |

REG-03 | Sent while verification of GST registration application to ask the taxpayer. Furthermore, this is to clarify details enter in the application and the documents provide. The same notice form is applicable for amending the GST registration. | Respond through reply letter in REG-04 clarifying the information provide | 7 working days from the date of receiving the notice | Such application reject and the applicant is inform for the same in REG-05 electronically |

17( REG) | SCN asking justification as to why the GST registration of taxpayer. Moreover, it should not be cancel for the reasons mention in the notice. | Respond through reply letter in REG-18 giving justifying reasons as to why GST registration should not be cancel | 7 working days from the date of receiving the notice | GST registration is cancel in REG-19 |

REG-23 | SCN asking justification as to why the cancellation of taxpayers GST registration It should revoke for the reasons discuss in the notice. | Reply through reply letter in REG-24 | working (7 days) from the date of receiving the notice | Cancellation of GST registration will revoke |

REG-27 | For migration of taxpayers from VAT to GST regime. A notice may be issue within the specific time. In REG-26 for not making an application after obtaining provisional registration. Furthermore, it is not for providing complete or accurate details in it. | Respond by applying in REG-26 and appear before the GST authority it provide reasonable opportunity to be heard | None | Cancellation of provisional registration issued in REG-28 |

PCT-03 | SCN for the GST practitioners misconduct. | Respond within the time specify in the SCN | Within the time specify in the SCN | Order for the cancellation of the individuals license as a GST practitioner |

RFD-08 | SCN asking why GST should not refund to the taxpayer | Reply through letter in RFD-09 | 15 days from the date of receiving the notice | Rejection of GST refund application order in RFD-06 |

ASMT-02 | Notice seeking additional information. Moreover, this details for carrying out provisional assessment under GST | Respond in ASMT-03 with require documents | 15 days from the date of receiving the notice | Possible rejection of application for provisional assessment |

06 (ASMT) | Notice seeking additional information for carrying out final assessment. It is under GST for applicants of provisional assessment. | Respond in 15 days of receiving the notice | 15 days from the date of receiving the notice | ASMT-07 may authorise without considering the applicants views |

ASMT-10 | Scrutiny notice intimating discrepancies in file GST returns after scrutiny. It is along with any payable tax, interest, or other amounts relate to such discrepancy. | Reply in ASMT-11 providing reasons. These reasons are for the discrepancies in GST returns | Within the time specify in the notice, or within 30 days from the service date. These dates are such as such notice or such deadline notified | Assessment of taxpayer is proceed on the basis of the information available which may lead to prosecution and penalty |

ASMT-14 | SCN for assessment under Section 63 reasons for assessing depend on best judgement | Respond in written and then appear before the GST authority who issue the notice | 15 days from the date of receiving the notice | Assessment order in ASMT-15 may not favour the individual being assessed |

ADT-01 | Notice for an audit to be conducted by a GST authority under Section 65 | Attend in person as specify in the notice, or produce relevant records | Within the time specify by the notice | Taxpayer is presumed to not be in possession of books of accounts it will initiate proceedings |

RVN-01 | Notice is issued under Section-108 by the revisional authority to the taxpayer before the revision order of appeals is passed it is giving the taxpayer enough opportunity to be heard Revision order is usually passed to fix errors in appeal orders passed under Section 108. | Respond in specify time, and/or appear before the GST authority who has passed the revision order on a given date and time | 7 working days from the date of receiving the notice | Decided ex-parts based on merits and records available |

Enquiry Notice by Directorate of Anti-profiteering | When supplier does not pass the benefit of ITC or reduced GST rates to the supplier. All interested parties get a notice asking for additional information | Cooperate in proceedings and provide all required evidence | As specified in the notice | Proceedings will be initiated ex-parte by the Directorate of Anti-profiteering. Furthermore, it is based on the evidence available. |

DRC-01 | SCN issued for demanding unpaid or shortly paid tax with or without fraudulent intention. In addition, served along with details statement in DRC-02. | Respond in RDC-03 for paying the demanded tax. This amount as per the notice with any applicable interest and penalty. If no fraud is committed penalty is charged only if payment is made after the prescribed time limit) respond to the SCN through DRC-06. | 30 days from the date of receiving the notice | Order may be passed with higher penalty or prosecution. This is within 3 years from the due date of filing annual returns of the financial year for which tax is payable. |

10 & 17 (DRC) | Auctioning goods under Section 79(1)(b) a reference to the demand order will be given. Furthermore, it being the order of recovery through specified officer under Section 79, Or, Recovery by executing the decree. | Should be able to pay the outstanding demand as per form DRC-09 | As specified by the notice before the sale. In addition, last day of auction/bid cannot be before 15 days from the issue date of notice | E-auction and sale |

DRC-11 | Notice to the successful bidder. | Payment of the full amount of the bid/auction | Within 15 days from the auction date | Re-auction will be conducted by the proper officer. |

DRC-13 | Recovering outstanding tax from a third person. | Deposit specify amount as per the notice and respond in DRC-14. | Not Applicable | Considered as defaulter with respect to the specify amount. This amount is as per the notice and may be subjected to prosecution and penalty. |

16 (DRC) | Notice for attachment and sale of movable/immovable goods/shares under Section 79. | Taxpayer will be prevent from transferring or creating a charge. It can change in any way on the said goods, any transfer or charge will be invalid. | Not Applicable | Any contravention of the notice may invite prosecution and/or penalty. |

How are GST Notices sent by the Department?

As per the CGST Act Section 169, there is a define set of modes for communication of GST notices. Any other means of communication of GST notices will not consider valid under the GST laws. Furthermore, there are different modes for communicating GST notices are:

Hand-delivery either directly or by courier to the taxpayer or his/her representative

Registered post, speed post, or courier with acknowledgement. In addition, it addressed to the taxpayer’s last known place of business

E-mailing to taxpayer’s authentic e-mail address

Making the notice available on the GST portal after login is made

Publishing in regional newspaper and circulating in the taxpayer’s locality. Moreover, it as per taxpayer’s last known address of residence)

Affixing the notice in some prominent place at the taxpayer’s last known address of business or residence GST authorities do not find it reasonable, a copy of the notice. Moreover, it may be affix on the notice board of the office of the recognise officer/authority.

Note:

In case the taxpayer receives a notice from any other modes of communication. Furthermore, apart from the ones regularly notify by the GST law as discuss above, he or she is not require to act on the notice.

FAQs

Yes, a Chartered Accountant or any other representative he or she can be recognise by the taxpayer for the purposes of reply to GST notices on his behalf.

The reply to GST Notices can be done through submitting response online on GST Portal. In addition, while doing so, taxpayers may use their own respective digital signature certificate or e-signature that is respective recognise personnel

The user will be intimate from the TaxHelpdesk expert to upload the documents in his documents once he place an order regarding GST notices. Furthermore, if the user wants to upload any document before discussing with the expert at TaxHelpdesk he still can do so uploading the documents in his designate account.

Reviews

There are no reviews yet.