- Which form of GST Return is to be filed by persons deducting tax?

- Who all are required to file Form GSTR-7?

- Rates of TDS

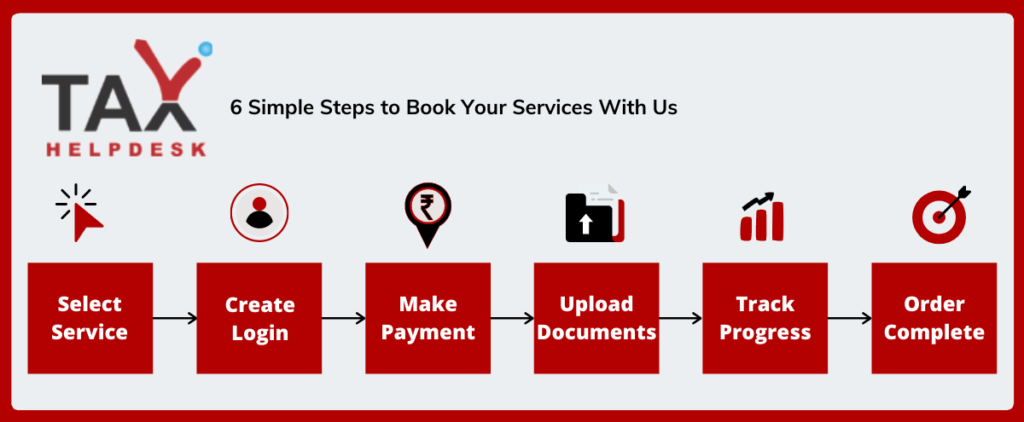

- Know how to book your GSTR-7 Return filing with TaxHelpdesk

- Form GSTR–7A

- Contents of GSTR-7

- By when should the GSTR-7 be filed?

- What happens if you file your GSTR-7 late?

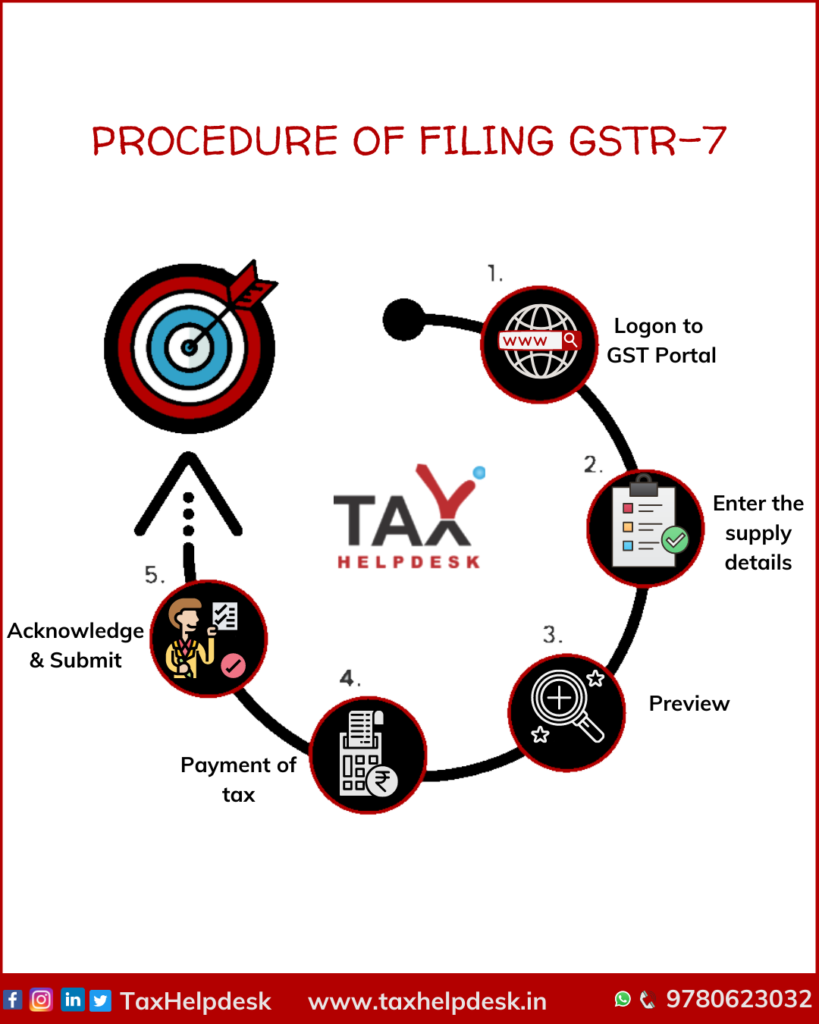

- Step by step procedure of filing of GSTR-7

- Requisite documents for filing of GSTR-7

- FAQs

This GSTR Plan is designed for the persons who deduct tax at the time of making/crediting payment to suppliers towards the inward supplies received.

GSTR-7 filing plan includes:

– Making entries of tax deducted at source

– Making amendments in details of TDS wrt any earlier period

– Making entries of TDS paid

– Submitting any other information like late fees and interest

– Creation of Challan

– Downloading of Form 7A

– Full assistance in filing of GSTR-7

Reviews

There are no reviews yet.