- Know about Import and Export Code

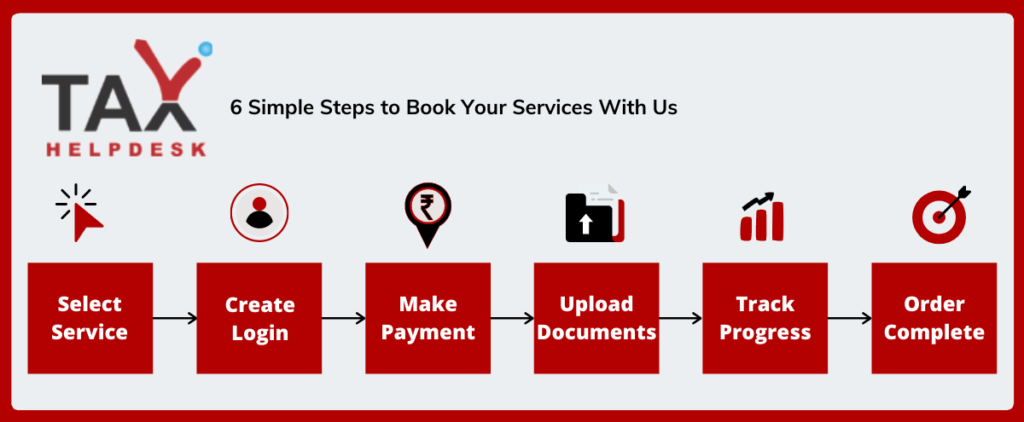

- How to obtain your Import and Export Code Registration from TaxHelpdesk?

- Uses of Import & Export Code Registration

- Cases in which Import & Export Code is not mandatory

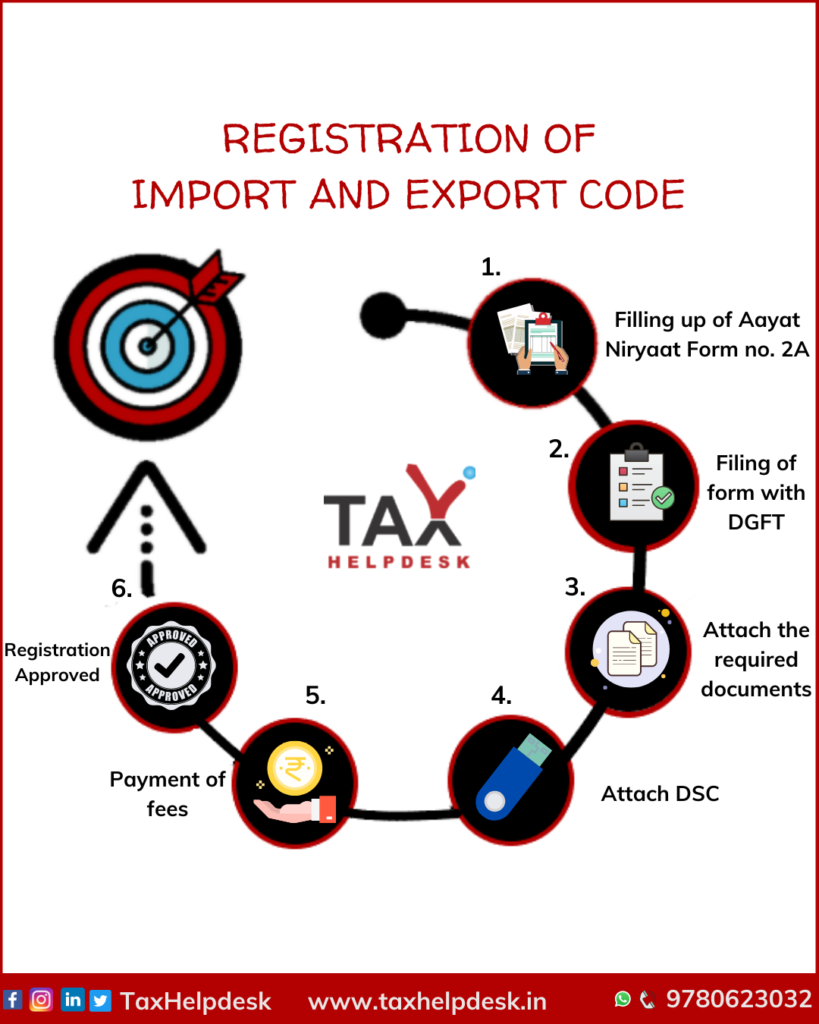

- Import & Export Code Registration Steps

- Documents required to be submitted for IEC Registration

- Time involved in obtaining registration of Import & Export Code

- FAQs

Import and Export Code is a compulsory perquisite for the persons involved in either importing or/and exporting goods or/and services from India. So, if you want to import or export your goods, then get your IEC Registration from TaxHelpdesk at nominal costs!

Documents required for Import and Export Code Registration are

– PAN Card Copy of the Individual/Firm/Company

– Copy of Identity Proof of Individual/Firm/Company

– Cancelled cheque copy of Bank’s Current Account of Individual/Firm/Company

– NOC from the landlord, where the business is situated

Registration

SERVICE: Import & Export Code Registration

CATEGORY: RegistrationPRICE: ₹999.00

*Government and other charges extra

Reviews

There are no reviews yet.