ITR filing for small taxpayers

Plan details

Are you a small taxpayer (having small earnings like from tuition, boutique etc) or someone with presumptive income? Let the tax experts at TaxHelpdesk simplify your income tax return filing process and ensure compliance with the applicable rules and regulations.

ITR filing for small taxpayers or presumptive taxation scheme details

List of services for the plan:

- Filing of Income Tax Return through the presumptive taxation scheme

- Declaration of set percentage of profits as per the turnover / receipt

- Interest income calculation

- Declaring of dividend income

- Providing of proper claim of tax saving instruments

- Declaration of income from house property (single or multiple)

- Tax refund and tax due intimation

- TaxHelpdesk’s Income Tax expert due support throughout the entire process

Persons eligible for this plan

Persons not eligible for this plan

- Person who is a Director in a Company, or

- Person who has held any unlisted equity shares at any time during the previous year,

- Or person who has any asset (including financial interest in any entity) located outside India,

- Or person who has signing authority in any account located outside India, or

- Person who has income from any source outside India,

- Or is a person in whose case payment or deduction of tax has been deferred on ESOP.

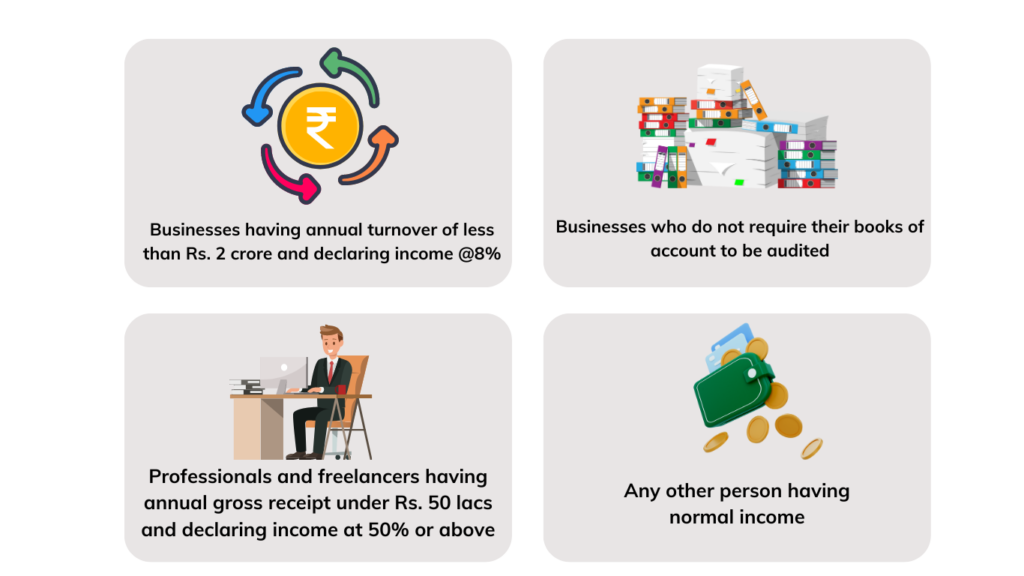

- Individual whose books of accounts are to be audited

- Individual whose business has an annual turnover of more than Rs. 2 crores

- Lastly, Freelancers or professionals having annual gross receipt of more than Rs. 50 lacs

Documents required for filing of ITR-4

FAQs

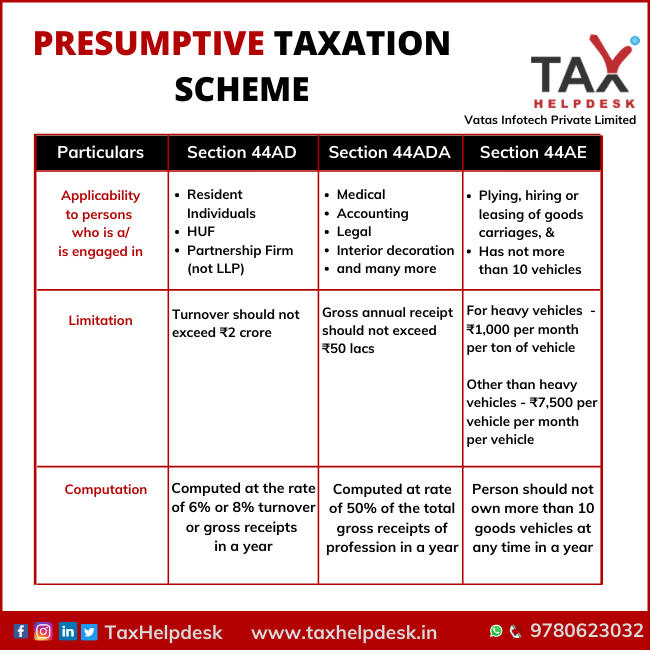

The presumptive income scheme is available to certain categories of small taxpayers, including individuals, Hindu Undivided Families (HUFs), and partnerships, whose total turnover or gross receipts in the previous financial year do not exceed a specified limit (currently set at Rs. 2 crore).

The presumptive income scheme is a simplified taxation scheme offered by the Income Tax Department of India. It allows eligible small taxpayers, such as individuals engaged in certain professions or businesses, to declare their income at a predetermined rate without maintaining detailed books of accounts.

The presumptive taxation scheme offers several benefits, such as reduced compliance burden, simplified record-keeping requirements, and lower tax liability. It also eliminates the need for regular tax audits for eligible taxpayers.

Under the presumptive taxation scheme, income is calculated based on a prescribed percentage of the total turnover or gross receipts. The specific percentage varies depending on the nature of the business or profession.

No, the presumptive taxation scheme is applicable only to certain specified categories of small businesses and professionals, such as small traders, retailers, manufacturers, and professionals like doctors, lawyers, architects, etc. Other businesses or professionals may not be eligible for this scheme.

Reviews

There are no reviews yet.