Compliances Overview of limited Liability Partnership

All the Limited Liability Partnership registration are required to be registered with Ministry of Corporate Affairs and this registration mandates that the LLP’s comply with the rules and regulations

List of Compliances for Limited Liability Partnership

The list of compliances for Limited Liability Partnership are:

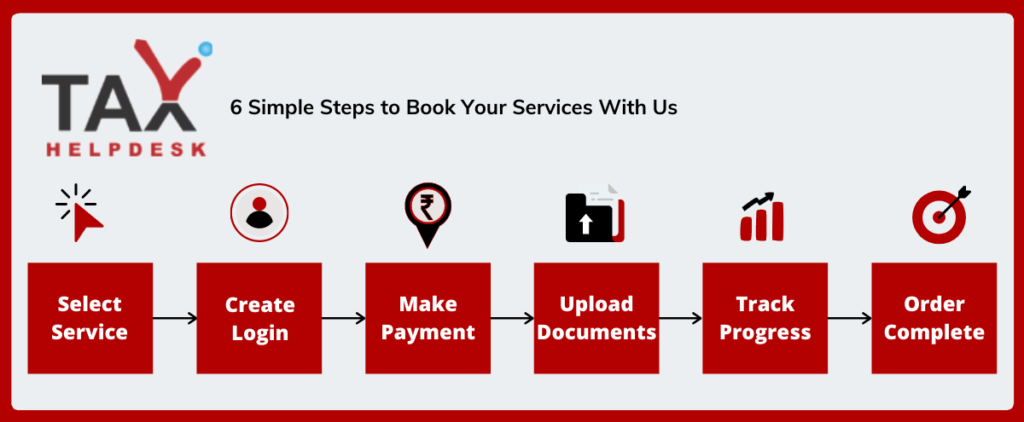

How to get your LLP Compliance done from TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Details of compliances of LLP Registration in India

1.Annual Return comprises of two forms: Form 8 and Form 11

a) Form 8

Form-8 consists of the statement of Account and Solvency. It consists of information related to the statement of assets of the LLP and liabilities and statement of income and expenditure of the LLP. It should be filed within 30 days from the end of 6 months of the end financial year. i.e. by 30th October of each financial year, unless extended by Government.

b) Form 11

Form 11 is a summary of an LLP’s Partners. It also indicates whether there is any change in the management. Every LLP is required to file Annual Return in Form 11 to the Registrar within 60 days from the closure of a relevant financial year. In simple words, the Annual Return is to be filed on or before 30th May every year, unless extended by the Department.

2. Filing of Income Tax Return

The LLP’s are required to file their Income Tax Return through filling ITR-5

Income Tax Slab for LLP

The LLP firm is taxed at the rate of 30% and the partners of the firm are taxed as per the individual’s income tax slab rate.

Note:

Health & Education cess @ 4% is also levied for partnership firms.

Surcharge @12% is also charged along with the cess, if taxable income exceeds ₹1 Crore.

Marginal relief shall also be provided, wherever applicable

3. Filing of GST Returns

If the LLP is registered under GST, then it is also required to file GST Returns. Usually, the GST registered LLP’s have to file GSTR-1, GSTR-3B and GSTR-9 returns. If the firm has opted for composition scheme, then GSTR-4 is to be filed.

4. TDS Return

In case the LLP has a valid TAN, then the TDS Returns are to be filed. The type of return to be filed depends upon the purpose of deduction. Following are the types of TDS Retur:

Form 24Q – TDS on Salary

Form 27Q – TDS where deductee is a non-resident, foreign company

Form 26QB – TDS on payment for transfer of immovable property

Form 26Q – TDS in any other case

5. EPF Return filing

In any LLP, where there are 10 or more employees employed, the EPF Registration becomes essential. After registration, the EPF returns are to be filed during each financial year.

6. Accounting and bookkeeping

Books of account are required to be maintained, if the LLP’s sale/turnover/gross receipts from the business is more than Rs. 25,00,000 or the income from business is more than Rs. 2,50,000 in any of the 3 preceding years.

7. Tax Audit

LLP is required to have a tax audit carried out if the sales, turnover or gross receipts of business exceed Rs. 1 crore in the financial year.

Note:

The threshold limit of Rs. 1 crore for tax audit is proposed to be increased to Rs. 5 crore w.e.f., AY 2020-2021, if the cash receipts are limited to 5% of the gross receipts or turnover.

Documents to be submitted for LLP Compliance

– Details of the firm

– PAN Card copy of the Partners

– Aadhaar Card Copy of the Partners

– TAN of the firm

– GST details of the firm

– Details of sales and purchases made during the relevant financial year

– Details of expenses made during the relevant financial year

– Bank account details and statements

– Credit card statements

– Details of TDS Challan deposited

FAQs

Income Tax Returns are to be mandatorily filed by all the registered LLPs, irrespective of any activity in the firm.

The filing fees is Rs. 50 for Form-8 and for Form-11.

The penalty of Rs.100/day if you have not filed this form.

Reviews

There are no reviews yet.