- Concept of Limited Partnership Firm

- What is Limited Liability Partnership Agreement?

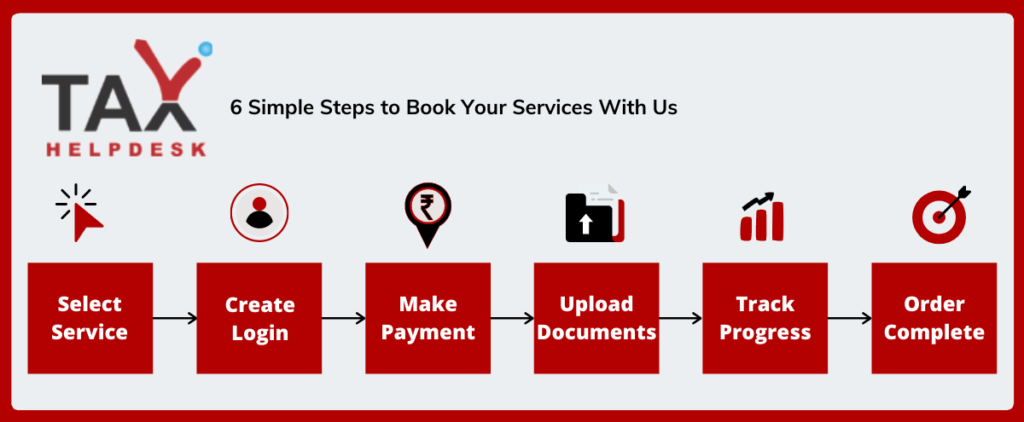

- How to get your LLP registered through TaxHelpdesk?

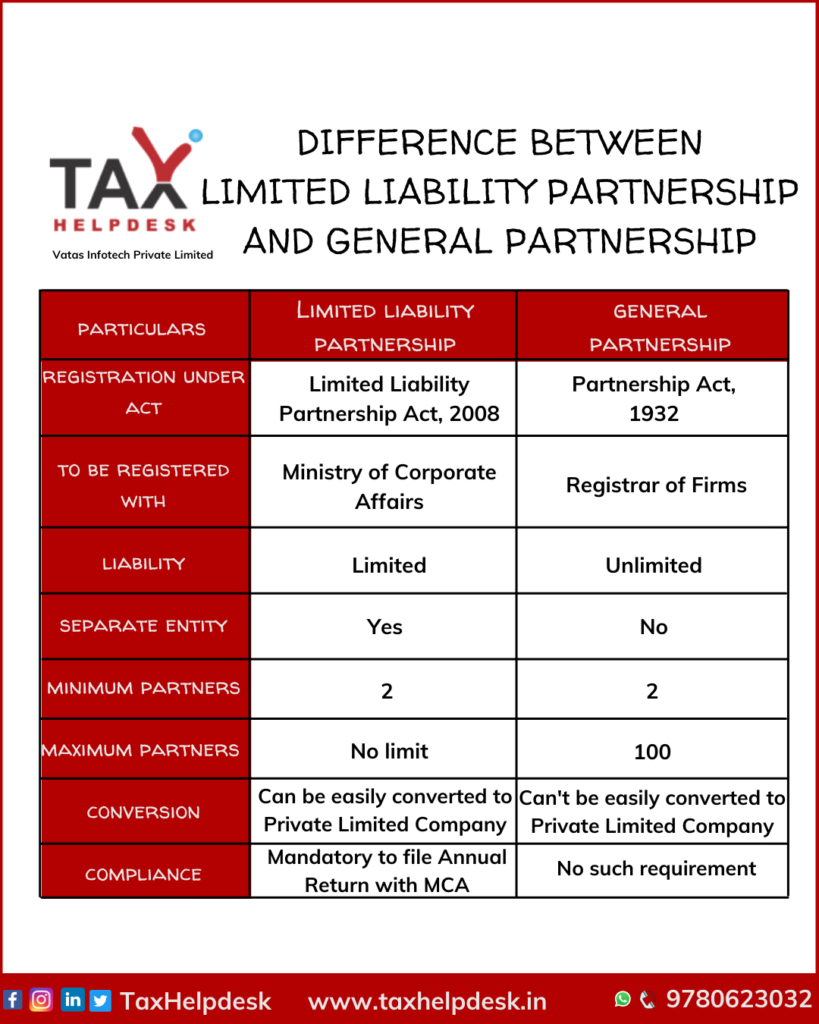

- Difference between Limited Liability Partnership & General Partnership

- Procedure of Registration of LLP

- Documents that are to be submitted for LLP Registration

- Time Framework for obtaining LLP Registration

- Positives & Negatives of getting LLP Registration

- FAQs

In limited liability partnership, the liability of the partners is limited to their share in the partnership. In order to start a LLP, it must be registered with the Ministry of Corporate Affairs. TaxHelpdesk can help you in getting LLP registered at lower costs and minimal time!

Package of Limited Liability Partnership includes

– Applying for Digital Signature Certificate two partners

– Applying fees Director Identification Number two partners

– Free consultation by TaxHelpdesk experts on Selection of name of LLP

– Application fees for approval of LLP name by MCA

– Framing of LLP Agreement

– Firm’s PAN and TAN

– Opening of current account in bank

New Business

SERVICE: Limited Liability Partnership

CATEGORY: New BusinessPRICE: ₹2,999.00

*Government and other charges extra

tax_admin –

*Government and charges extra!