- Public Limited Company as per Companies Act

- Requirements for Company

- Categories of Company

- Get your Public Limited Company registered through TaxHelpdesk

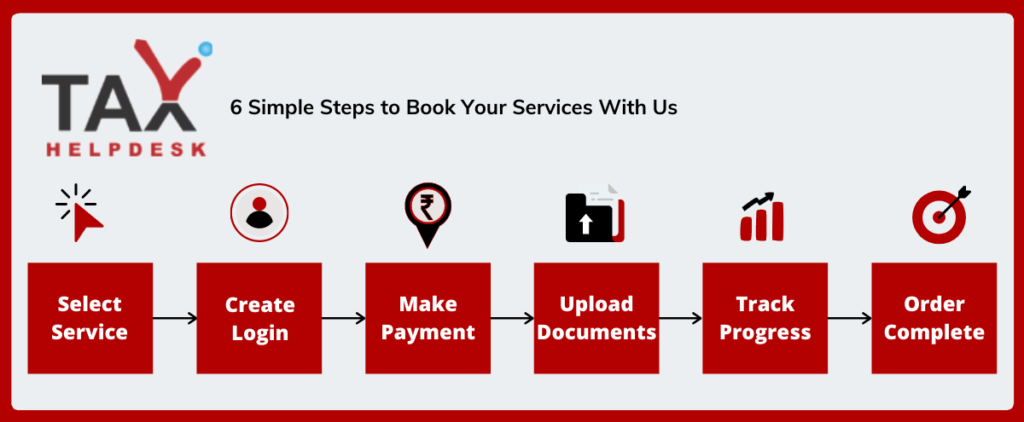

- What is the registration process?

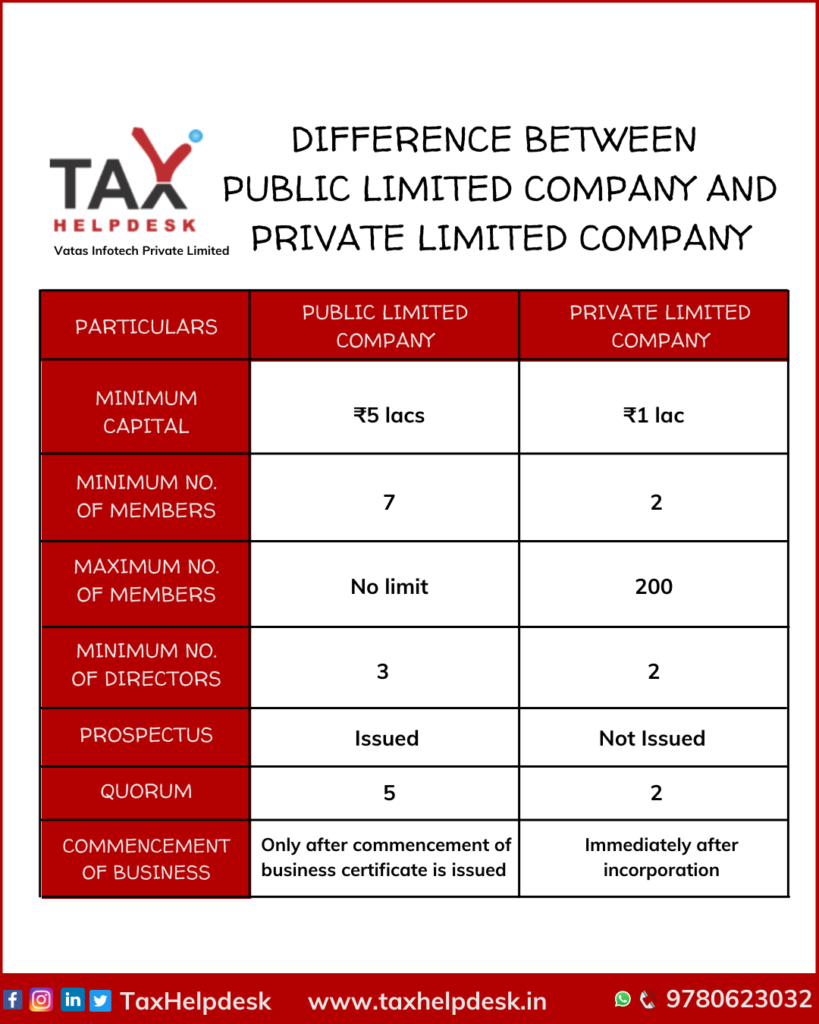

- Difference between Private Limited Company & Public Limited Company

- Documents to be submitted for registration

- Time limit for registration

- Advantages & Disadvantages of Public Limited Company

- FAQs

Public Limited Company is a company that has limited liability and offers shares to the general public. Get your Public Limited Company registered from TaxHelpdesk experts at lowest fees!

Package of Public Limited Company includes

– Applying for Digital Signature Certificate

– Applying fees for Director Identification Number

– Drafting of Memorandum of Understanding and Articles of Association

– Application fees for reservation of name of company

– Filing of SPICe INC forms

– Company’s PAN and TAN

– Opening of current account in bank

– Incorporation Certificate

– Free Consultation with TaxHelpdesk’s experts!

New Business

SERVICE: Public Limited Company

CATEGORY: New BusinessPRICE: ₹2,999.00

*Government and other charges extra

Reviews

There are no reviews yet.