Income Tax Notices by Income Tax Department

In today’s time, the Income Tax Department has become stringent and keeps an active eye on tax evaders. If there is even a slightest discrepancy, then the assessee is sure to get an Income Tax notices. Therefore, it is always advisable of experts if the matter involves your income.

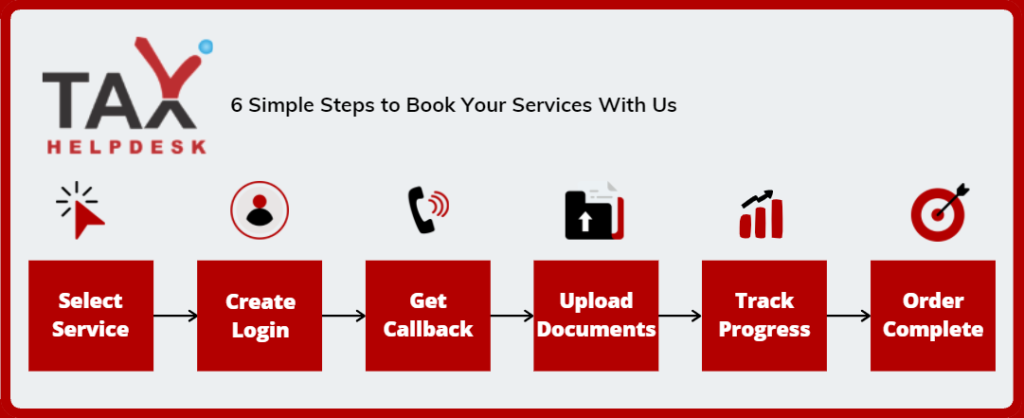

How to avail advice of TaxHelpdesk on Income Tax Notices?

After placing of service request, the tax experts from TaxHelpdesk will get in touch with the user within 24 working hours. If any document will be required by the user, then he shall be intimated about the same by the TaxHelpdesk expert. The document can be uploaded by the user in his account.

Reasons for which you can get Income Tax Notice(s):

The notices by the department can be sent either through post or by e-mail. Notices can be sent for the following reasons:

Non filing of Income Tax Return:

– Individual has made high value transactions in the financial year and has not filed return.

– Salaried individual on whose income tax has been deducted and has not filed return.

– Individual faced with heavy financial losses and did not file the return.

– Received a hefty gift in cash or in kind and did not file the return

Late filing of Income Tax Return

If the individual has not filed the return within the opening window of filing income tax return he shall get notice from the Income Tax Department.

Non-disclosure of income

If the tax has been deducted at source and individual has not shown the income while filing the income tax return the department can issue notice to him to show cause.

Tax credit mismatch

If the tax credit in Form 26AS and income tax return filed do not match the department can issue notice to him to show cause.

Non-payment of self-assessment tax

When the individual has filed the return even when the tax liability the tax was due to be paid, then the return filed will be considered to be a defective one and the department shall issue the notice.

Notice under Section 142(1) to produce details on salary, taxes paid, etc

This is a notification sent before the I-T Department starts investigation of the tax assessment as a preliminary examination. The department orders that the tax paying individual produce details on salary, ventures, taxes paid, assets and liabilities.

Some other Reasons For Which You Can Get Income Tax Notice(S):

Notice Under Section 143(2) to furnish financial documents

This is a scrutiny notice that is usually served after a notice under Section 142(1) is sent out. You could receive this notice up to 6 months after the end of the assessment year. Receipt of this notice means that your case has been chosen for detailed investigation. This investigation need to furnish all relevant financial documents – income, investments, exemptions and deductions availed, losses, etc. Notice under Section 245 to clear the previous dues

You are served a notice under Section 245 if you have claimed refund on the tax paid, but there are previous dues in your name. Through this notice, the department lets you know the refund you have claimed, the pending demands from the previous years. If you do not respond to this notice, the dues and refunds will be adjusted against each other.

Notice under Section 139(9) for proof of income

If there is an error in the ITR filed by you or any relevant income/investment proof has not been attached, the department will send you a notice under Section 139(9). You need to reply to this notice within 15 days or the return will be considered as not filed.

Documents required for replying to Notices

The user will be asked to upload the required documents only after assessing the type of Income Tax Notice he has got from the Income Tax Department.

FAQs

Yes, you still can get Income Tax Notice even if you have filed your Income Tax Return within the due date. The Income Tax notice is not wholly dependent on filing/non filing of Income Tax Notice. For instance, if you have underreported your income to save taxes, at the time of filing of ITR. Then the chances are very likely that you will get served with Income Tax Notice from the department.

The notices are generally required to be replied within 15 days from the date of the notice or as stated in the notice.

If you refuse to receive the Income Tax Notice, the also you cannot escape from your liability. In such cases, refusal also amounts to acceptance.

If the assessee is not present in person to receive the notice in person, then it can be handed over to any adult member of the family. In addition, the notices are also sent on the registered mail address of the assessee.

Reviews

There are no reviews yet.