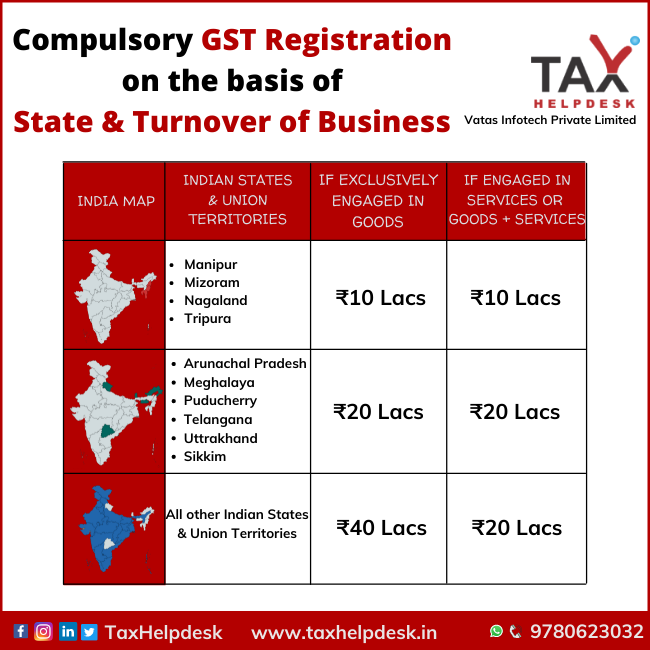

GST Registration on basis of State & Turnover

GST being a tax on the event of “supply”, every supplier needs to get registered. However, businesses having Annual Aggregate Turnover (AATO) of more than the prescribed limit as per their business in the relevant State are required to obtain GST Registration.