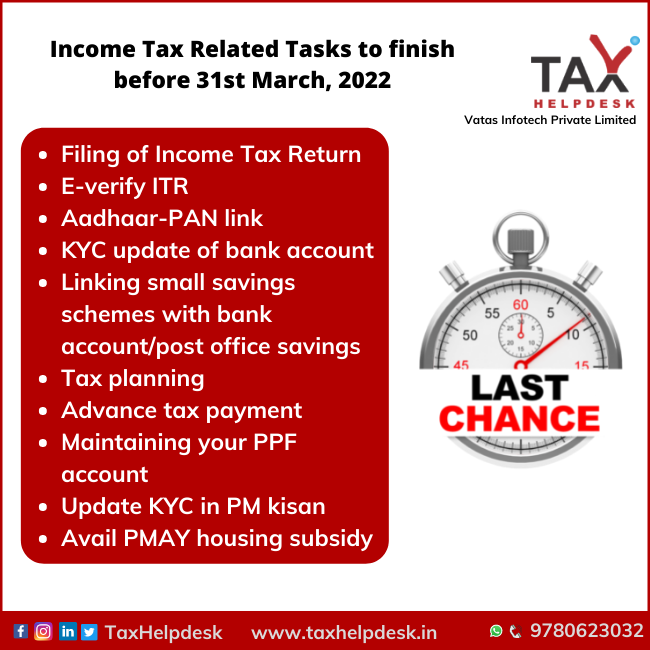

Income Tax Related Tasks to finish before 31st March, 2022

31st March, 2022 is around the corner. The taxpayers must make sure that they complete the following 10 income tax tasks before the deadline of 31st March ends. 1. Filing …

Income Tax Related Tasks to finish before 31st March, 2022 Read More »